Nexus provisions for payroll tax

The nexus provisions of the Payroll Tax Act 2007 determine in which Australian jurisdiction payroll tax is to be paid.

What are nexus provisions?

An employee may provide services:

- wholly in 1 state or territory

- in multiple Australian states or territories, and/or

- overseas.

Nexus provisions in the Payroll Tax Act 2007 (PTA) help you determine in which jurisdiction you need to pay payroll tax. See sections 11 – 11C of the PTA.

Please note

If your business pays wages in other Australian states and territories, and you need to calculate your NSW payroll tax threshold, read the interstate wages page.

For specific nexus provisions that relate to shares and options read chapter 11 of the shares and options guide.

What you need to do

To complete your monthly returns and annual returns for payroll tax you need to correctly calculate the liable wages of your business.

This means identifying wages that are taxable in NSW, as well as any that may be taxable in every other Australian jurisdiction.

Wages taxable in another Australian jurisdiction must be recorded against interstate wages in the annual return.

Apply the following rules to the relevant situation of the employee to correctly determine which jurisdiction to report taxable wages.

Situation 1: Services performed wholly in 1 state or territory in a calendar month

If services in a calendar month are performed wholly in 1 state or territory, payroll tax is payable in that state or territory.

See section 11(1)(a) of the PTA.

Rita normally performs her duties in NSW.

In May Rita went to Queensland for a temporary assignment and performed all her services in Queensland that calendar month.

Wages paid to Rita in May are liable for payroll tax in Queensland.

Situation 2: Services performed in more than 1 state or territory and/or partly overseas in a calendar month

Nexus provisions provide a 4-tiered test to determine location of the payroll tax liability.

The tests must be applied in the sequence below.

See section 11(1)(b) of the PTA.

Test 1: Employee's principal place of residence

Payroll tax is payable in the state or territory where the employee’s principal place of residence (PPR) is that month.

If the employee has more than 1 PPR in that month, the employee’s PPR on the last day of that month is the one taken to be the PPR.

In the instance where a corporation is deemed to be an employee, the corporation’s PPR is taken to be the state or territory where:

- the ABN address is located, or

- its principal place of business (PPB), if it does not have an ABN address or has 2 ABN addresses.

If the corporate employee has more than 1 PPB in a month, the PPB is the address on the last day of that month.

Test 2: Employer’s ABN address or principal place of business

If the employee does not have a PPR in an Australian state or territory during that month, payroll tax is payable in the state or territory where the employer’s address for their ABN is located.

If the employer does not have an ABN address or has 2 or more ABN addresses in different states or territories, payroll tax is payable in the Australian state or territory where the employer’s PPB is located.

If the employer has more than 1 PPB in a month, the PPB is the address on the last day of that month.

Test 3: Where wages are paid or payable

Payroll tax is payable in the state or territory where the wages are paid or payable in a calendar month, if:

- the employee does not have a PPR in Australia

- the employer does not have an ABN address or PPB in Australia.

When wages are paid or payable in a number of states and/or territories, payroll tax is paid on the aggregate of the wages in the state or territory where the largest portion of wages is paid.

An employee, Sunita, does not have a PPR in Australia, and her employer, Green Pty Ltd, does not have an ABN address or PPB in Australia during October.

Sunita performs services and is renumerated as follows:

- $200 for New South Wales.

- $300 for Victoria.

- $1,000 for South Australia.

The tax is payable on the total amount of $1,500 in South Australia, since that is where the largest portion of wages was paid.

Test 4: Services performed mainly in NSW

Payroll tax is payable in NSW when services were mainly performed in NSW during the month, if:

- the employee does not have a PPR in Australia

- the employer does not have an ABN address or PPB in Australia, and

- wages are not paid in any Australian state of territory.

Services are mainly performed in NSW if the actual time worked in NSW is more than 50 per cent during the month.

Situation 3: Employment overseas

Employees working overseas for less than or equal to 6 continuous months

Wages are taxable in NSW when paid or payable to an employee who has performed services wholly overseas for up to 6 months continuously.

If only part of the wages earned by the expatriate employee is paid in NSW and the remaining part is paid overseas, the wages paid in NSW must be declared for payroll tax.

If the wages earned by the expatriate is paid in more than 1 state or territory, payroll tax is payable on the aggregate of the Australian wages in the state or territory where the largest portion of wages is paid.

Employees working overseas for more than 6 months

Wages paid in NSW are exempt from payroll tax if the employee has performed services wholly overseas for a continuous period of more than 6 months (inclusive of the wages paid for the first 6 months of services).

The 6-month period does not have to be within 1 financial year.

It will not be considered a break of continuity of service if the employee returns to Australia:

- for a holiday, or

- to perform services exclusively related to overseas assignments for a period of less than 1 month.

The period of continuous service overseas ends if the employee returns to Australia for any other circumstance.

A new period of continuous services starts again on the date the employee recommenced performing services overseas.

Services performed offshore, not overseas

Wages paid in NSW for services performed outside of any state or territory are taxable in NSW, irrespective of the assignment duration.

If the wages are paid in more than 1 state or territory, payroll tax is payable on the aggregate of wages, where the largest proportion is paid.

As the services are not performed overseas, the exemption for services provided overseas for a continuous period of more than 6 months does not apply.

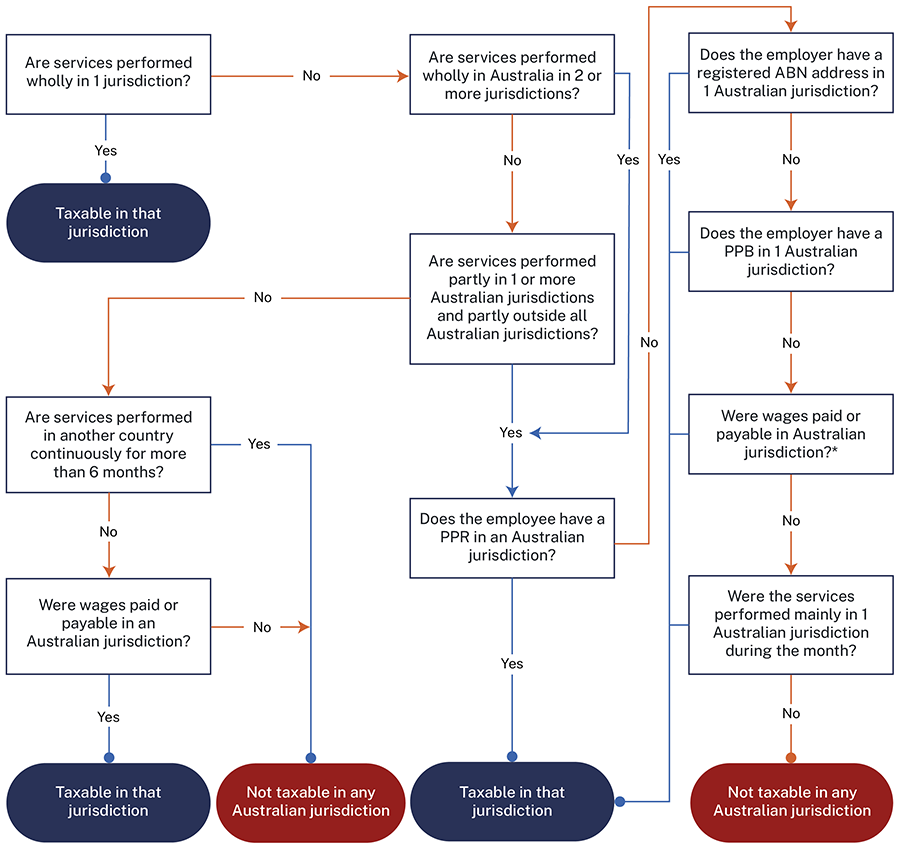

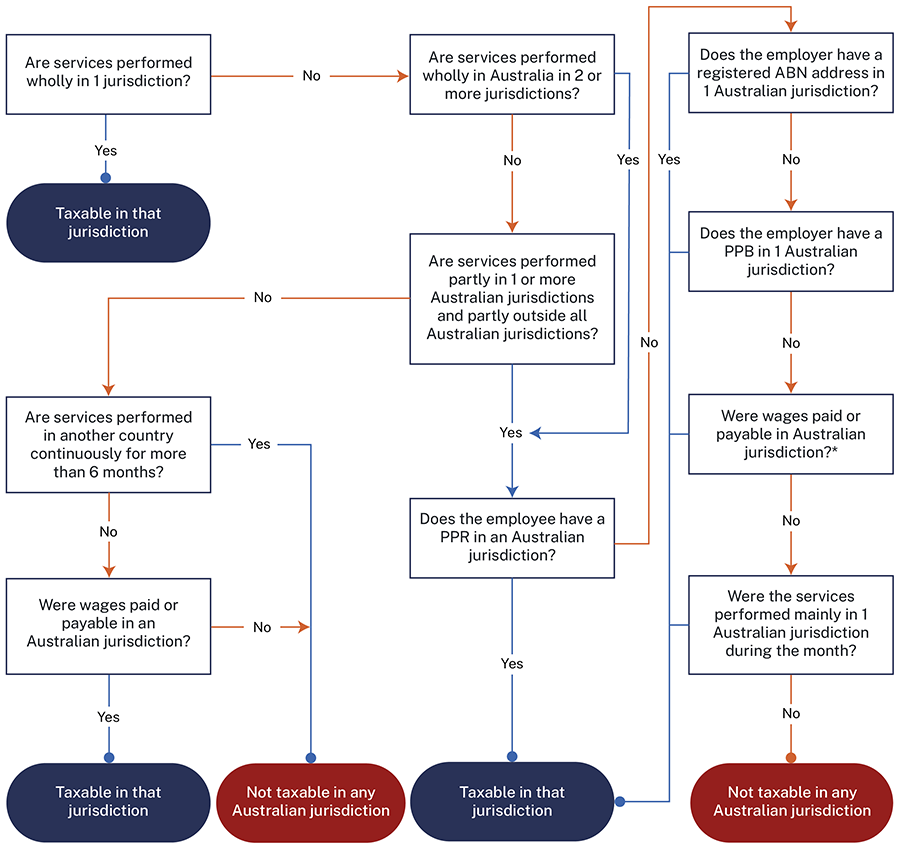

Nexus provisions flowchart

Establishing liability

This flowchart visually demonstrates how the nexus provisions are applied in various situations.

* Where wages are paid in 2 or more Australian jurisdictions, payroll tax is payable where the largest proportion of wages is paid.

ABN – Australian Business Number

PPR – Principal place of residence

PPB – Principal place of business

Common errors with nexus provisions

Payroll tax audits show that businesses often incorrectly declare in the wrong state or territory when services are provided wholly in 1 state or territory.

Errors in your payroll tax returns may result in a tax default or overpayment. If you have overpaid you may be entitled to a refund. Read more about refunds.

Voluntary disclosure

Contact us to make a voluntary disclosure if you have not declared all liable amounts in your monthly and/or annual returns, including previous financial years.

Voluntary disclosures attract a reduced level of penalty tax compared to cases where we identify an underpayment. Interest will still be imposed.

Non-compliance identified through our data matching activities will result in penalty tax and interest charges, in addition to any underpayments detected.