Payroll tax and the gig economy

The payroll tax implications for gig economy businesses, including three ways the employment relationship with gig workers may incur a payroll tax liability.

The ‘gig economy’ is a business model where individual workers provide services to customers for a fee via digital platforms.

This model is used in a range of industries, such as:

- ridesharing

- food and goods delivery

- personal or professional services.

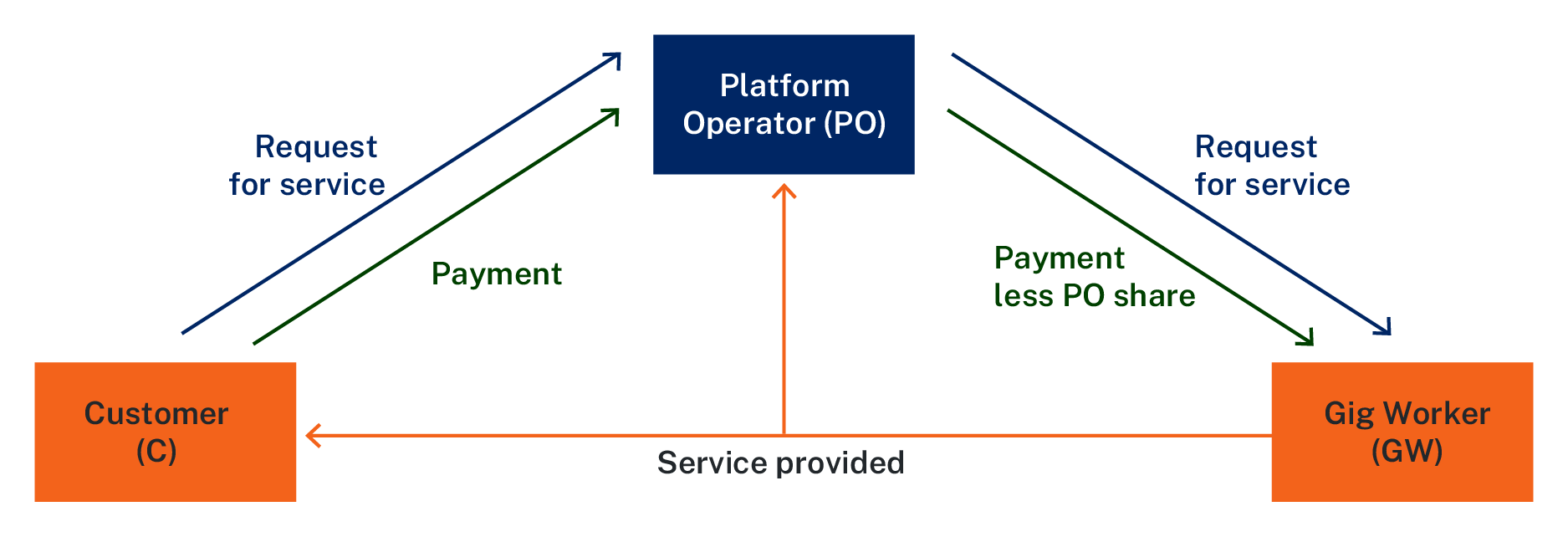

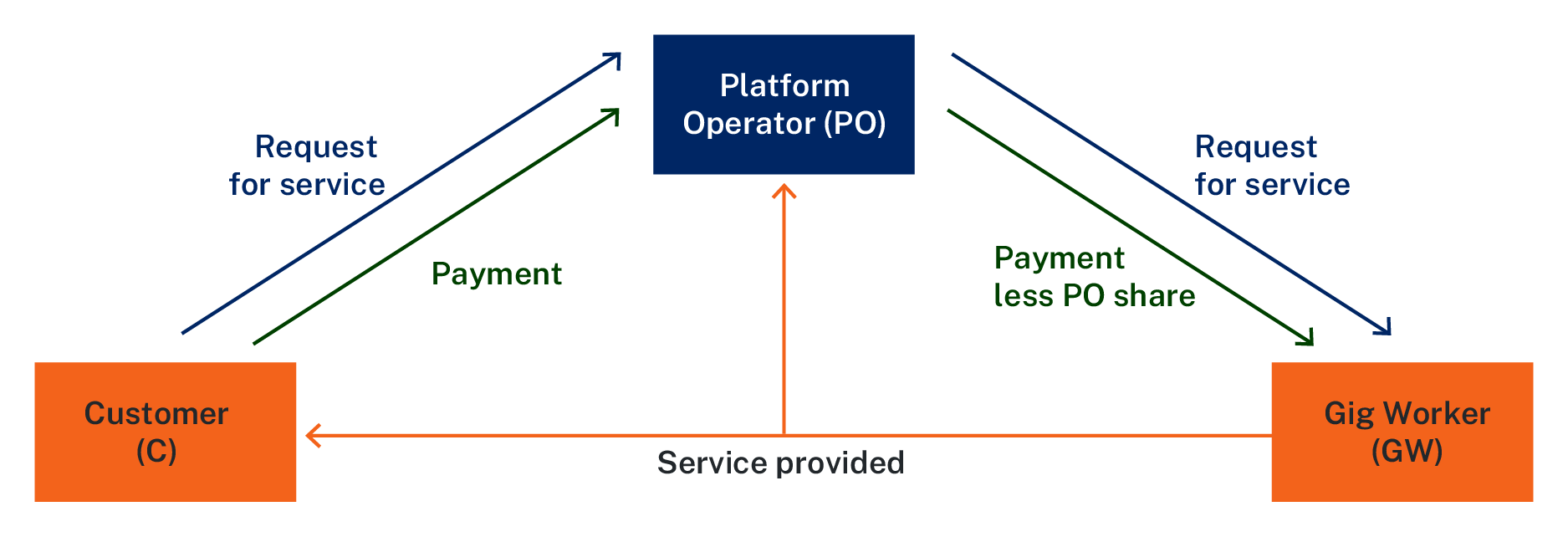

Example of a gig economy business model

There are usually three parties involved:

- Platform Operator – the business that provides and operates the digital platform.

- Gig Worker – a person who provides their personal services to Customers through the digital platform.

- Customer – a person or business receiving the services of the Gig Worker via the digital platform.

This diagram is an example of arrangements typically used in gig economy business models. However, it is not the only way the relationships can be structured.

Diagram 1: In this gig economy model, the Customer requests services from the Platform Operator, who then allocates the request to the Gig Worker (blue arrows). The Platform Operator also facilitates the payment from the Customer, distributing to the Gig Worker after taking a share (green arrows). The Gig Worker provides services (orange arrows) to both the Customer and Platform Operator by fulfilling customer service requests.

Payroll tax implications

How a gig economy business model is treated for payroll tax depends on the structure adopted and the arrangements between the parties.

The outcome is informed by:

- the nature and extent of services provided by each party, and

- the rights, obligations, and the extent of control of each party.

Generally, there are three ways the relationship between the Platform Operator and the Gig Workers may incur a payroll tax liability.

Gig workers as independent contractors

Gig Workers are often considered to be independent contractors, supplying their services to both Customers and the Platform Operator.

The “relevant contract” provisions (Division 7 of Part 3 of the Payroll Tax Act 2007) apply to these arrangements.

Unless one of the contractor exemptions apply, the labour component of payments made by the Platform Operator to the Gig Worker may be liable wages of the Platform Operator.

Read the contractors page for more details.

Gig workers as common law employees

In some instances, Gig Workers may be treated as employees of the Platform Operator under common law if they are found to be engaged under a “contract of service”.

Under these arrangements, payments made by the Platform Operator to Gig Workers are treated as liable for payroll tax under section 13 of the Payroll Tax Act 2007.

No contractor exemptions can apply if the Gig Workers are treated as employees.

For more details, read the contractors page and the employee or independent contractor section on the Australian Taxation Office (ATO) website.

Platform operator as employment agent

A Platform Operator may be an Employment Agent that procures the services of the Gig Worker for a Customer who operates a business, and the Gig Worker works in and for the business of the Customer in the same way, or much the same way, as employees of the Customer.

The “employment agency” provisions (Division 8 of Part 3 of the Payroll Tax Act 2007) may apply to these arrangements, with the effect that payments made by the Platform Operator to the Gig Worker may be subject to payroll tax.

Read the employment agencies page for more details.

What you need to do

You should conduct an internal review of your business to determine the correct payroll tax treatment of payments made to all workers.

Registered businesses

If you have identified an underpayment, or not declared liable amounts in your monthly payroll tax return for the current financial year, include these additional amounts in your next monthly return and/or annual return.

Unregistered businesses

If your taxable wages exceed the monthly payroll tax threshold in the current financial year, or the last four financial years, you must register for payroll tax.

Read more about how to register for payroll tax.

Voluntary disclosure

Voluntary disclosures attract a reduced level of penalty tax compared to cases where we identify an underpayment. Interest will still be imposed.

Non-compliance identified through our data matching activities will result in penalty tax and interest charges, in addition to any underpayments detected.

Contact us to make a voluntary disclosure if you have not declared all liable amounts in your returns, including previous financial years.

Contact the payroll tax team

If you have questions about this topic call 1300 139 815 or +61 2 7808 6904 for international callers.

You can also email [email protected]