2. Linked entities

What is a linked entity?

Companies and unit trusts can hold land and property in their own right, or they can hold an interest via linked entities.

A linked entity is a chain of entities – such as companies, unit trusts or partnerships – that are each entitled to the others’ property if it is distributed.

For acquisitions made on or after 1 February 2024

Acquisitions made on or after 1 February 2024, linked entities exist where either one or both of the following apply:

- At each link between two entities, one would receive at least 20 per cent of the value of the other’s property if it is distributed.

- If all of the entities’ property other than the principal entity’s were to be distributed, the principal entity would be entitled to at least 20 per cent (for private landholders only).

Linked entities examples

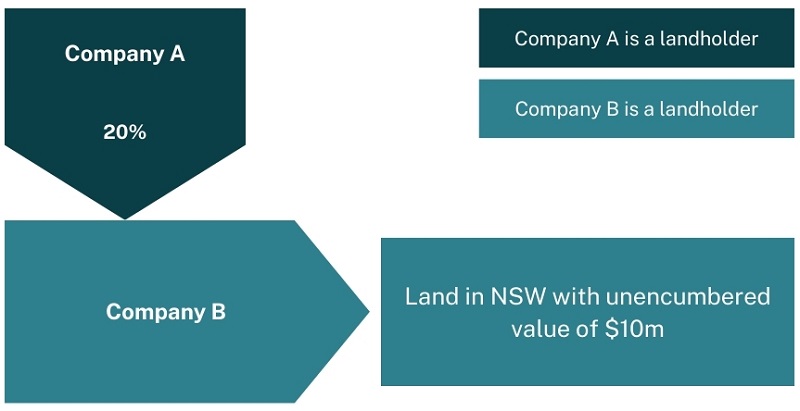

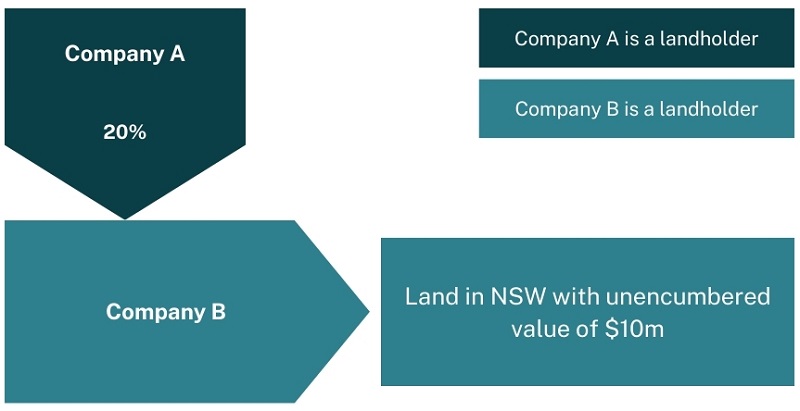

Example 1

In example 1, Company B is a linked entity of Company A because Company A would receive 20% of the value of Company B’s landholding if it is distributed.

Company A is considered to hold 20% of Company B’s landholding with unencumbered value of $10m. Company A is therefore a landholder because the value of its landholding is $2m, which is the threshold.

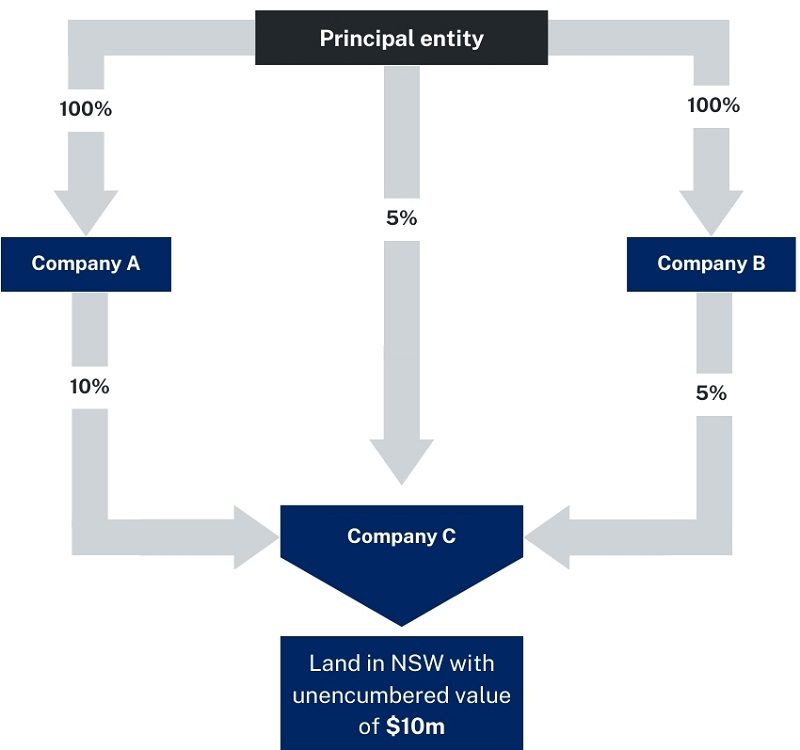

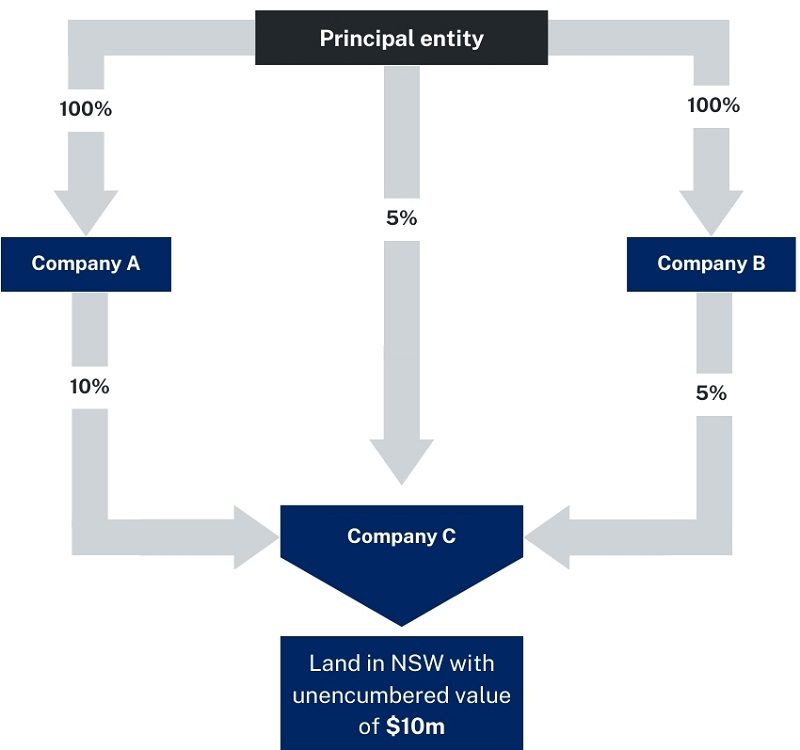

Example 2

In example 2, Companies A, B and C are linked entities of the principal entity because upon the notional winding up of these companies, the principal entity would receive at least 20% of the underlying land, i.e., 10% through Company A plus 5% directly through Company C plus 5% through Company B = 20%.

The principal entity is considered to hold 20% of the underlying land with an unencumbered value of $10 million. Therefore, the principal entity is a landholder because its landholding has unencumbered value of $2m, which is the threshold.

For acquisitions made prior to 1 February 2024

For acquisitions made prior to 1 February 2024, linked entities exist where either one or both of the following apply:

- At each link between two entities, one would receive at least 50 per cent of the value of the other’s property if it is distributed.

- If all of the entities’ property other than the principal entity’s were to be distributed, the principal entity would be entitled to at least 50 per cent (for private landholders only).

Linked entities examples

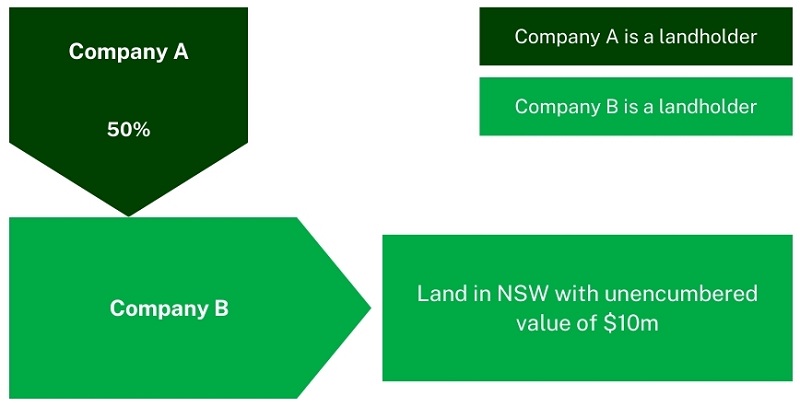

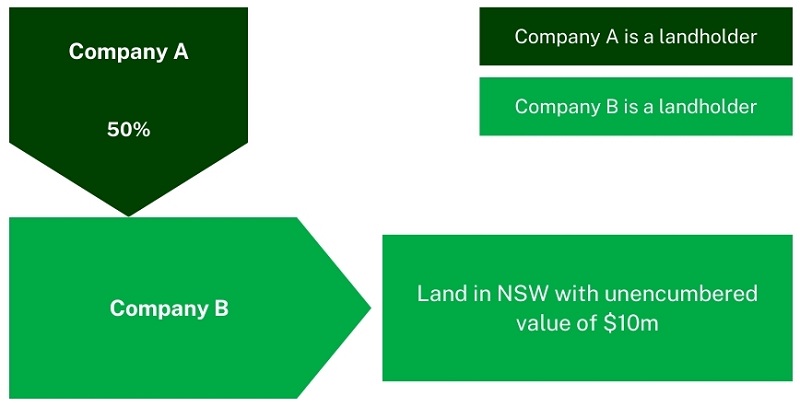

Example 3

In example 3, Company B is a linked entity of Company A because Company A would receive 50% of the value of Company B’s landholding if it is distributed.

Company A is considered to hold 50% of Company B’s landholding with unencumbered value of $10m. Company A is therefore a landholder because the value of its landholding is $5m, which is more than the $2m threshold.

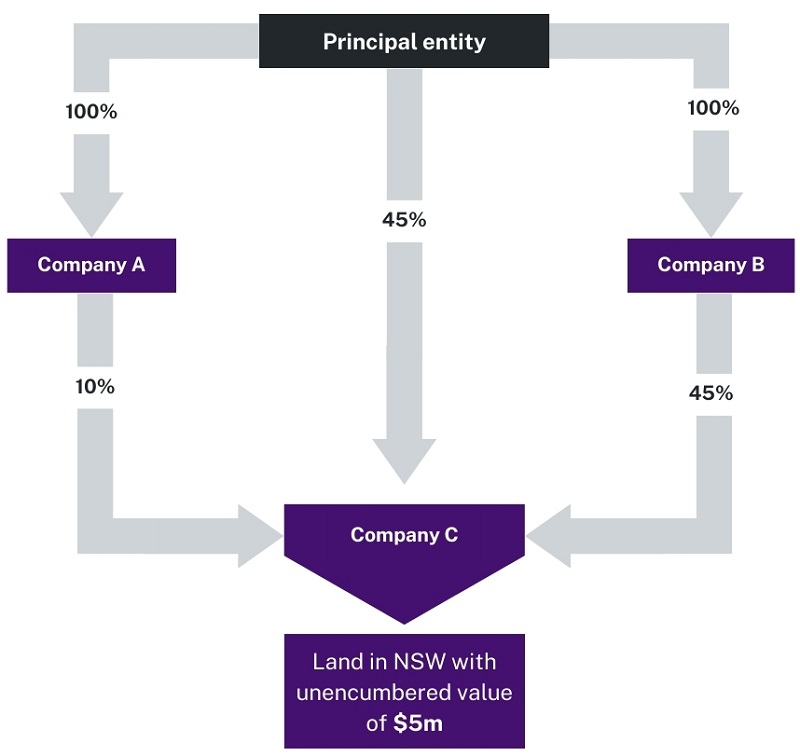

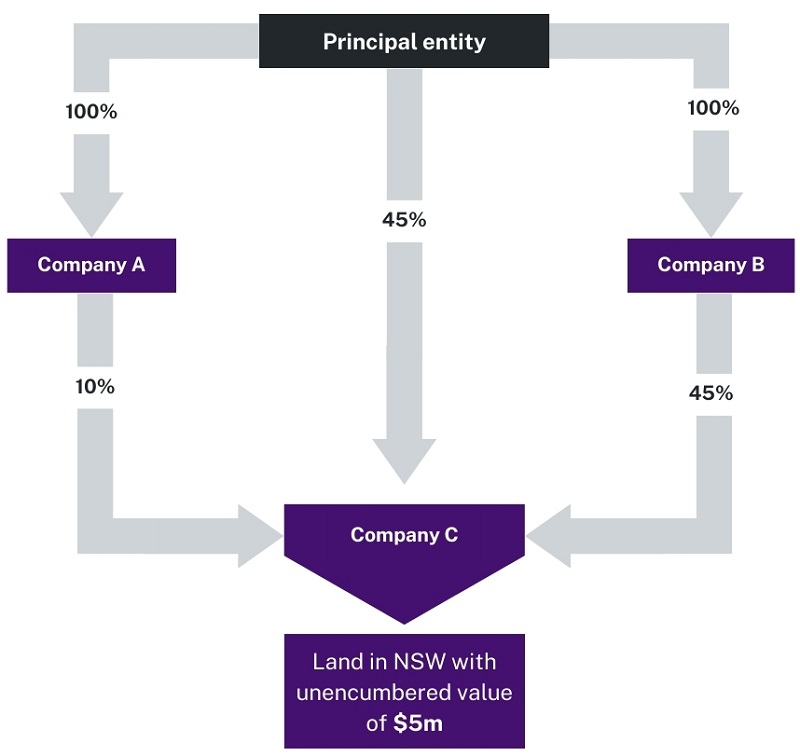

Example 4

In example 4, Companies A, B and C are linked entities of the principal entity because upon the notional winding up of these companies, the principal entity would receive more than 50% of the underlying land; i.e., 10% through Company A + 45% directly through Company C + 45% through Company B = 100%.

The principal entity is considered to hold 100% of the land with an unencumbered value of $5 million. The principal entity is therefore a landholder because the value of its landholding is $5m, which is more than the $2m threshold.