Under section 273B(2) of the Duties Act 1997, a reduction in duty may be applicable to eligible corporate consolidation transactions.

Eligible consolidations transactions

A corporate consolidation transaction is a transfer or an acquisition of an interest in a landholder (within the meaning of Chapter 4 of the Duties Act 1997) that:

- is made to interpose a corporation (the head corporation) between another corporation (the affected corporation) and the holders of the affected corporation’s securities, and

- is a transfer or an acquisition of securities of:

- the affected corporation by the head corporation for which the only consideration given by the head corporation is the issue or transfer of its securities to the person from whom the affected corporation’s securities were transferred or acquired, or

- the head corporation by a holder of securities of the affected corporation.

Corporation security

Corporation security (includes a unit trust scheme) of a corporation means:

- In the case of a corporation other than a unit trust scheme, an issued share of the corporation, or

- In the case of a unit trust scheme, a unit issued under the scheme.

Read more in Section 273D of the Duties Act 1997

Acquisitions of an interest in a landholder

A transfer or an acquisition of an interest in a landholder is not a corporate consolidation transaction if, immediately before the transaction or acquisition occurred, the head corporation held dutiable property or a vehicle or an interest in a corporation.

A transfer or an acquisition of an interest in a landholder is not a corporate consolidation transaction unless, immediately after the issue or transfer of the head corporation’s securities:

- each person who holds those securities (a security holder) is a person who held securities of the affected corporation immediately before the securities of the affected corporation were transferred to or acquired by the head corporation, and

- the proportion of those securities held by each security holder is the same as proportion of the securities of the affected corporation held by each security holder before the issue or transfer.

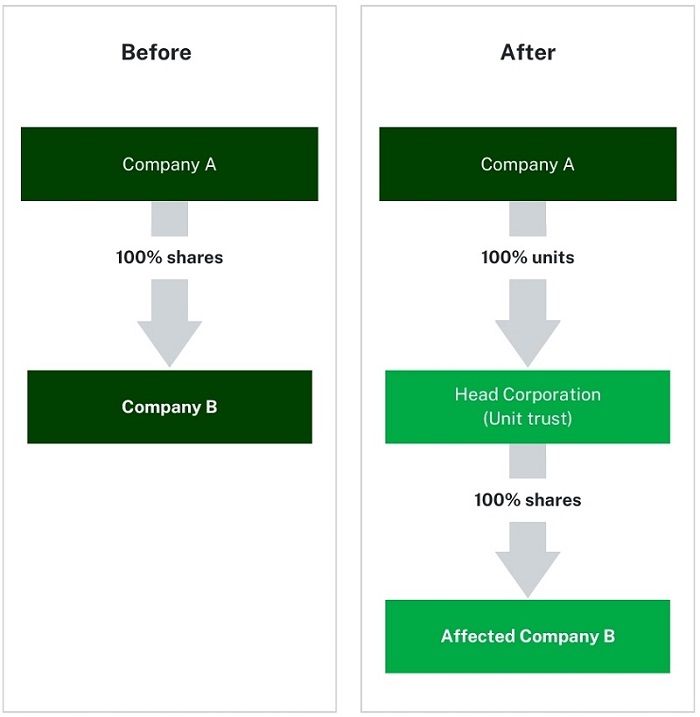

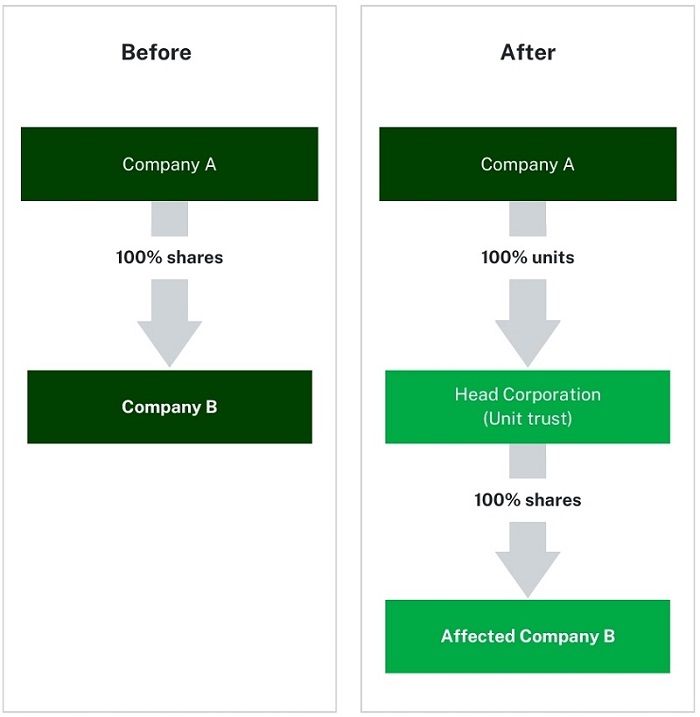

Corporate consolidation example

The example below shows the before and after of a corporate consolidation structure.

Before the consolidation, shareholders held 100% shares in Company B.

As a result of a corporate consolidation:

- shares in company B were exchanged for units in the head corporation (unit trust) and

- the head corporation now holds the shares in company B.