ESS interests provided under an Employee Share Scheme

1. What is an Employee Share Scheme?

An Employee Share Scheme is a scheme under which a company grants an “ESS interest” to an employee or “associate” of the employee.

2. What is an ESS interest?

An ESS interest in a company is a beneficial interest in shares in the company or a subsidiary of the company, and includes stapled securities, rights and options.

3. Grant of an ESS interest to an associate

A grant of an ESS interest to an associate is subject to payroll tax under s.46 of the Payroll Tax Act as if it were a grant provided directly to an employee, a deemed employee or a director.

An “associate” is defined in s.318 of the ITAA 1936, and includes people and entities such as relatives, closely connected companies, or trustees of a trust (other than the trustee of an employee share trust).

Example

A partner is an associate of the partnership; an individual's spouse is an associate of the individual;;an individual may also be an associate of a self-managed super fund of which they are a member, or beneficiary of a family trust.

4. Employers may choose between the grant date and vesting date

Employers may choose to include the taxable value of an ESS interest in their payroll tax returns when the ESS interest is granted or when it vests.

Note:The date on which shared and options are taken to have vested are defined in s.19 of the Act.

Example 1: Shares vest when granted

An employee is entitled to shares, with no conditions attached, under the company’s Employee Share Scheme, and the shares are allotted to the employee. The shares are “granted” and also “vest” on the day they are allotted.

5. When are shares or options granted?

An ESS interest provided under an Employee Share Scheme is “granted” to an employee when:

- the share or option is transferred;

- the share is allotted;

- the right to an option is conferred or otherwise created;

- the employee is registered as the owner of a share or option in the company’s register; or

- the employee acquires a beneficial interest in a share or option even though the person is not registered as the owner in the company’s share register.

6. When do shares or options vest?

a) Vesting date of a share

This is the earlier of the following dates:

- the date when any conditions which apply to the grant of the share have been met so that the employee’s legal or beneficial interest in the share cannot be rescinded; or

- seven years after the date on which the share was granted.

Example 2

ABC Pty Ltd allots shares in the company to an employee, but the shares will be forfeited if the employee resigns or is sacked within three years. The shares will vest in three years’ time provided the employee is still employed by the company.

b) Vesting date of an option or a right

This is the earliest of the following dates:

- when the share to which an option or right relates is granted;

- when the right to have the relevant share transferred, allotted or vest is exercised;

- seven years after the date on which the option or right is granted (or 10 years if the option or right was granted before 1 July 2011, if the employer chooses).

Example 3

On 2 March 2016 ABC Ltd grants an employee options to purchase shares at a discount, exercisable on 2 March 2019, but the right to the options will lapse if the employee ceases to be employed by the company at any time before the three years expires. The options will vest in three years’ time provided the employee is still employed by the company and exercises the options.

7. ESS interests with nil taxable value when granted are never liable

If an ESS interest has a nil taxable value on the date of the grant, the employer is deemed to have elected that date as the relevant day (see s.20(2) of the Act). This means no taxable wages need to be returned when the ESS interest vests, even if the ESS interest has a positive taxable value on vesting.

Example 4

The managing director of a company is granted options to purchase shares in 12 months’ time under the Company’s Employee Shares Scheme. The options have a nil taxable value on the date of the grant.

When the options are exercised, (the vesting day) the share price has increased substantially, and the taxable value of the shares is $20,000.

The company is not liable for payroll tax on vesting, even though the options have a positive taxable value (i.e. market value less consideration) because they had a nil taxable value when granted.

8. Employers who choose to pay tax on vesting

If an ESS interest has a positive taxable value on the date of the grant, the employer may include the taxable value in its next monthly or annual return. If not, the employer is deemed to have chosen the vesting date as the relevant day.

Employers who choose to pay on vesting cannot retrospectively change their choice to pay on the grant.

Example 5

On 2 March 2016 ABC Ltd granted its CEO options to purchase shares in the company. The options may be exercised in three years’ time, on 2 March 2019. The options had a taxable value of $1,000 on 2 March 2016, the date they were granted. The Company did not include the grant in its March 2016 monthly payroll tax return, due on 7 April 2016, or in its annual return due on 21 July 2016.

The CEO exercises the options on 2 March 2019, which is the vesting day. The options had a taxable value of $10,000 on the vesting day. The Company must therefore include the $10,000 in its monthly return for March 2019, due on 7 April, or in its annual return due on 28 July 2019. The company cannot retrospectively choose to pay tax on the grant of the options, when the taxable value was $1,000.

Note: If the taxable value on 2 March 2016 (the “grant” date) was nil, the company would have no liability when the options were exercised (and therefore vest) on 2 March 2019, regardless of the taxable value on that date.

9. Determining the taxable value of an ESS interest

The value of an ESS interest is the value on the grant or vesting day (called the “relevant day”).

The taxable value on the relevant day is the value of the shares or options, less any consideration paid or payable by the employee.

a. Employers’ choice of valuation method

Employers who include an ESS interest in a return when required to do so under s.87

of the Act, may choose between the following valuation methods:

- a valuation method which provides a true market valuation guidance on market valuation methodologies can be found on the web, including ATO information on market valuation methods for Commonwealth tax purposes which can be found on the ATO website.

- a methodology prescribed in Commonwealth Regulations under s.83A-315 of the Income Tax Assessment Act 1997 (Cth). This is the existing Regulation, which are applicable in valuing unlisted rights to acquire shares under employee share schemes

b. Commonwealth “safe harbour” methodology

Employers cannot use the “safe harbour” methods of valuing unlisted ordinary shares. These methods are not prescribed under s.83A-315 of the ITAA 1997 and do not provide a true market value of shares because they do not take into account the value of intellectual property or goodwill.

c. When the Chief Commissioner may decide the valuation method

If an employer commits a tax default by not including the taxable value of an ESS interest as required by the Act, the Chief Commissioner may determine which valuation methodology must be used.

d. Valuation when making a voluntary disclosure of a default

An employer who commits a tax default and wishes to make a voluntary disclosure must seek the Chief Commissioner’s approval of the valuation methodology before lodging a return. If approval is not obtained, the Chief Commissioner may determine the value using a different method to that used by the employer and reassess accordingly.

e. Effect of conditions on valuation

Conditions that prevent or restrict conversion of an ESS interest to money, such as employee performance requirements or continuation of employment for a specified time period, are disregarded in determining the market value of the shares or options.

Example 6

ABC Ltd grants 1,000 shares to an employee and issues the shares on condition that the shares cannot be sold for three years. On the date of the grant the value of the shares based on the listed price is $5,000, but the restriction on selling the shares reduces the market value to $4,500.

The taxable value on the grant date is $5,000 because the restriction on sale is ignored in determining the value.

f. Taxable value is reduced by value of consideration

An ESS interest may be granted at no cost to the employee, or the employee may have to provide consideration in cash or a non-cash form. Both cash and non-cash consideration, other than consideration in the form of services, is deducted from the value of the ESS interest in determining the taxable value.

Example 7

ABC Ltd grants 1,000 shares to an employee at a cost of $1,000 (ie $1 per share) but the grant will be rescinded if the employee ceases to be employed within three years. On the date of the grant the value of the shares based on the listed price is $5,000.

The taxable value on the grant date is $4,000 ie $5,000 less $1,000 in consideration. The value of the employee’s services over the next three years is disregarded.

g. Commonwealth tax concessions don’t apply for payroll tax purposes

The Commonwealth Government provides tax or other concessions in relation to employee share schemes from time to time. These Commonwealth concessions do not apply for payroll tax purposes.

Example 8

ABC Ltd grants 1,000 shares valued at $1,000 to an employee at no cost. The employee is not liable for Commonwealth income tax or capital gains tax under Commonwealth tax concessions applying to an eligible employee share scheme.

The taxable value on the grant date is $1,000 because the Commonwealth tax concessions do not affect the taxable value for payroll tax purposes.

h. Other ESS interests not provided under an Employee Share Scheme

Shares or options provided to an employee, including a former or prospective employee (or to an associate) that are not provided under an Employee Share Scheme may be fringe benefits under the Fringe Benefits Tax Assessment Act 1986 (Cth). If so, provision of the shares is subject to payroll tax on the type 2 grossed up value (see Division 2 of Part 3 of the Payroll Tax Act).Revenue Ruling PTA 003 V3 explains the application of payroll tax to fringe benefits.

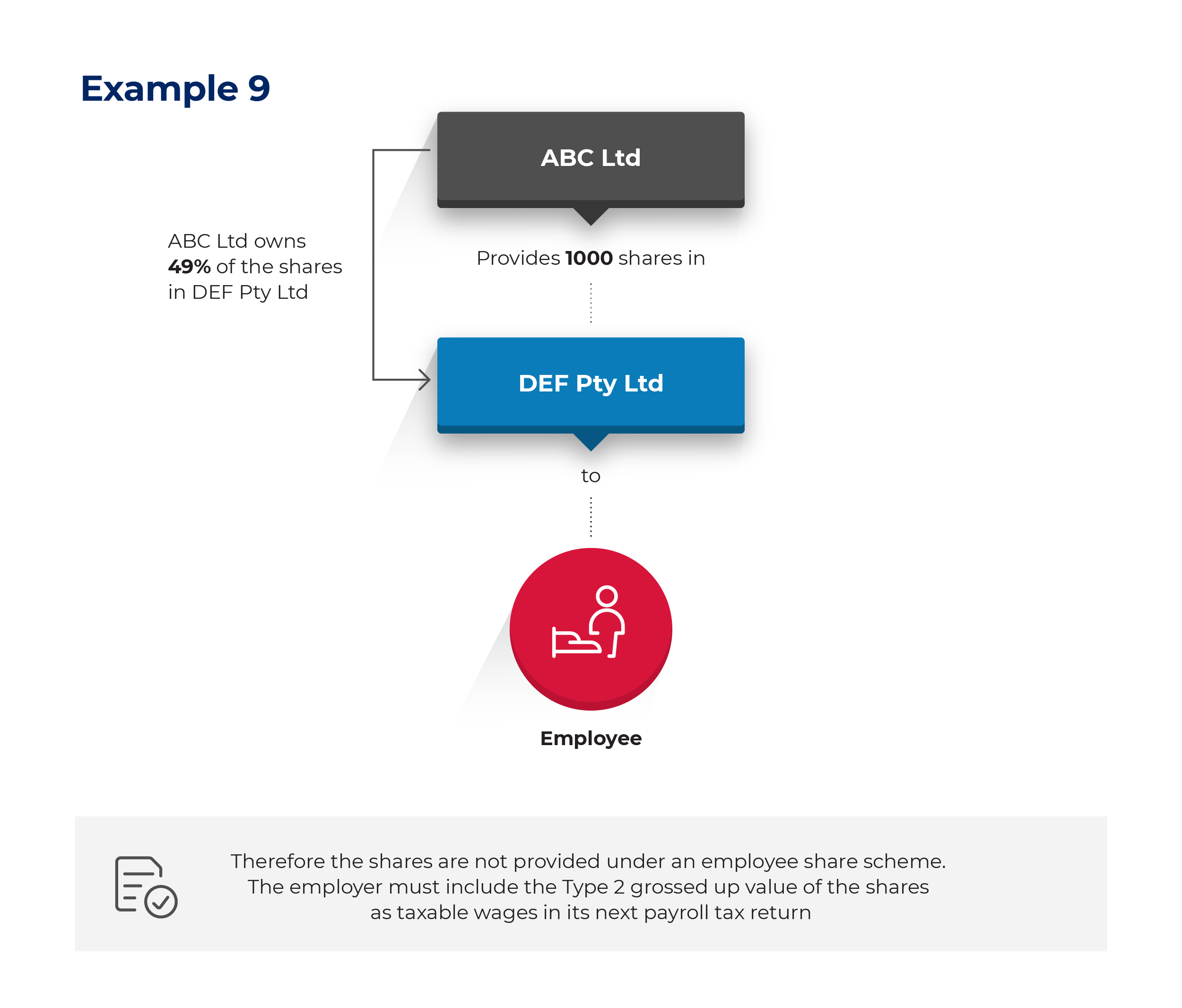

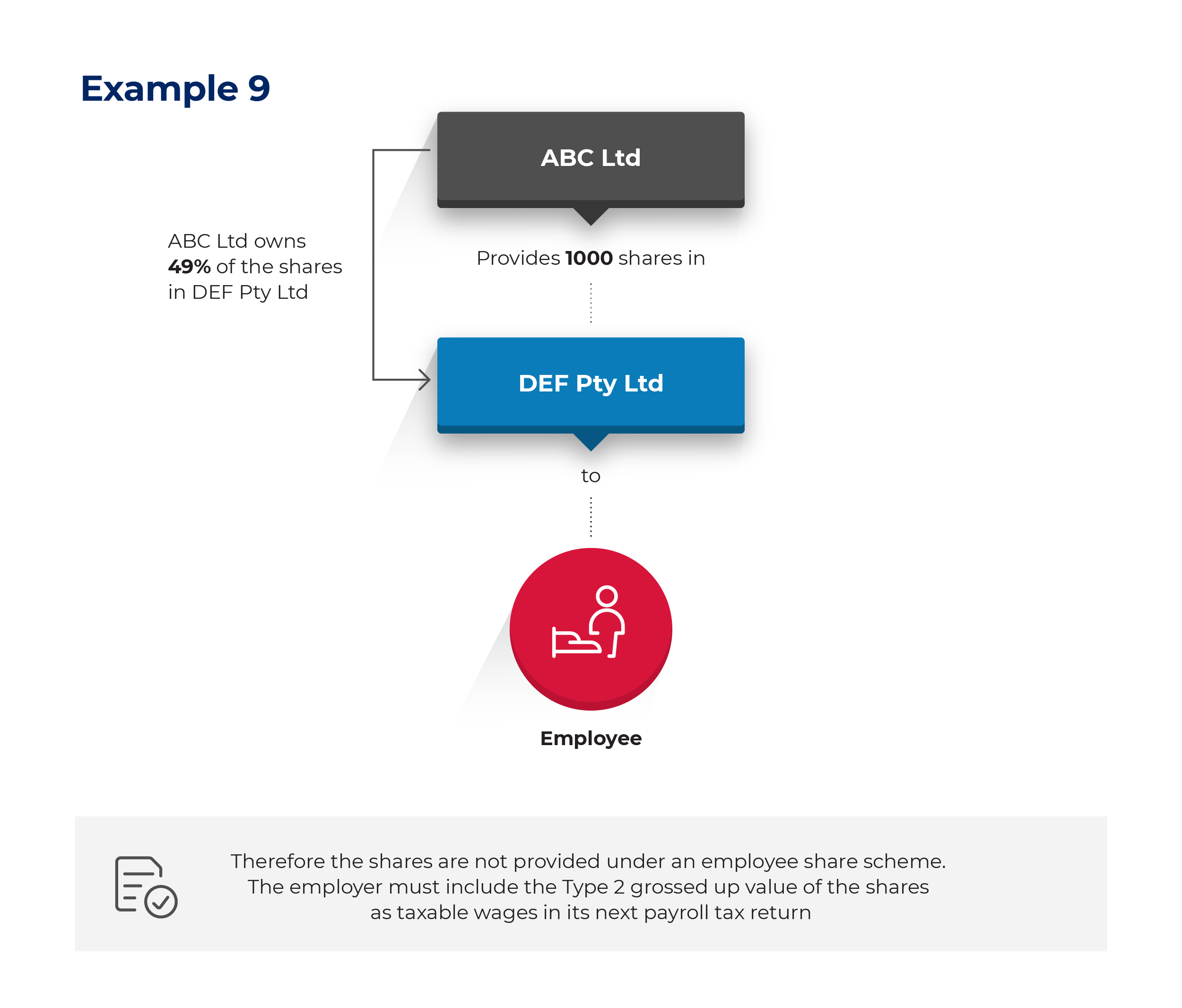

Example 9

ABC Ltd provides 1,000 shares in DEF Pty Ltd to an employee as part of the employee’s remuneration package.

ABC Ltd owns 49per cent of the shares in DEF Pty Ltd, but DEF Pty Ltd is not a subsidiary of ABC Ltd. Therefore, the shares are not provided under an employee share scheme.

The shares are a fringe benefit, and ABC Ltd must include the Type 2 grossed up value of the shares as taxable wages in its next payroll tax return.

The shares may be valued using the same methodologies that may be used to value an ESS interest provided under an Employee Share Scheme.

10. Indeterminate rights

An “indeterminate right” is not an ESS interest and is therefore not liable to payroll tax as an ESS interest at the time the right is granted.

However, an indeterminate right becomes an ESS interest on the date that shares or options are granted. The ESS interest is not deemed to have been granted retrospectively for payroll tax purposes, unlike the position under Commonwealth tax legislation.

Examples of indeterminate rights include:

- a right to acquire shares to a specified value using a price determined at a future date;

- a right to acquire an unspecified number of shares at some time in the future;

- a right to either a specified amount of cash or an ESS interest of a specified value at a future time, and the employer can choose either cash or the ESS interest.

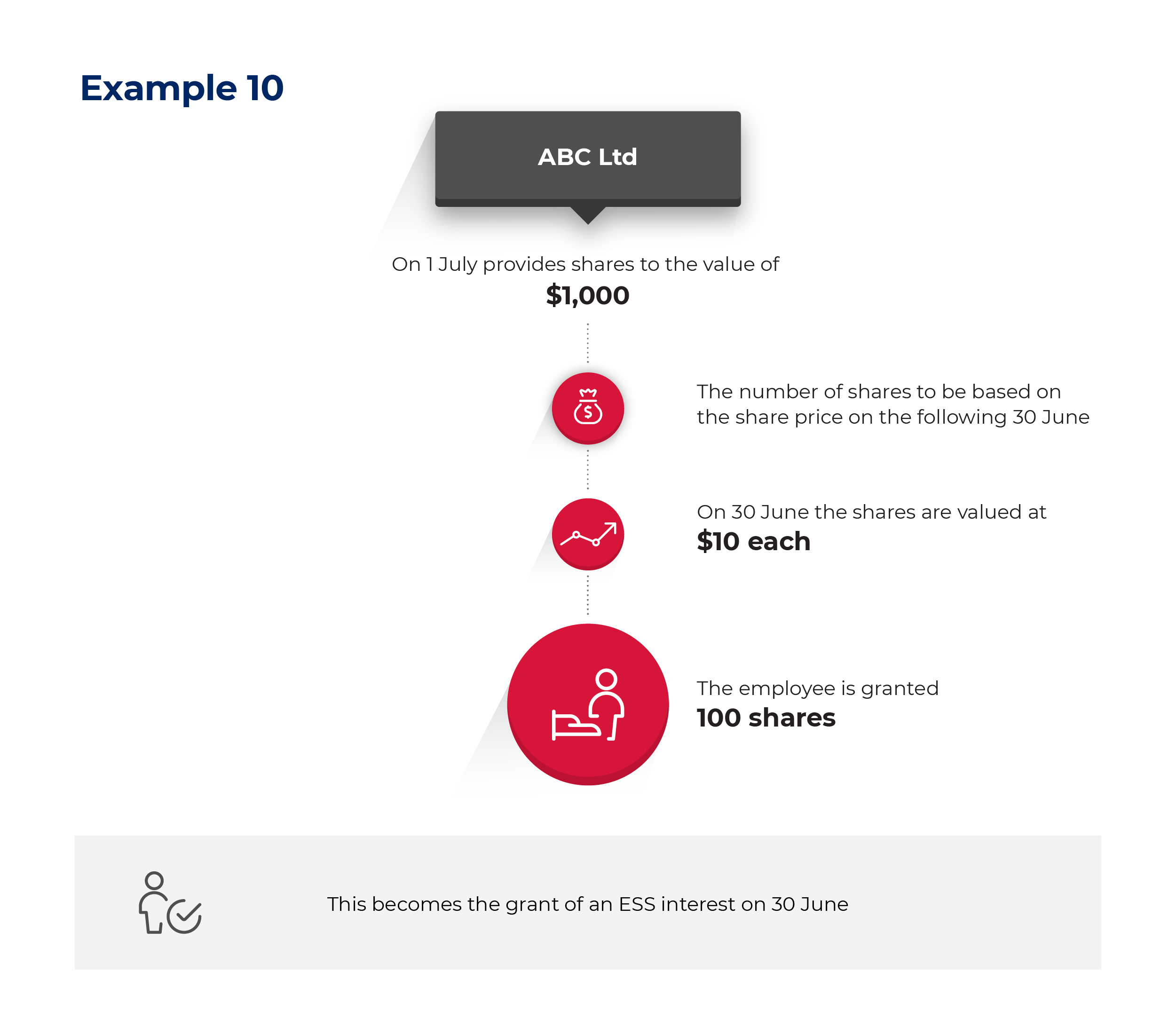

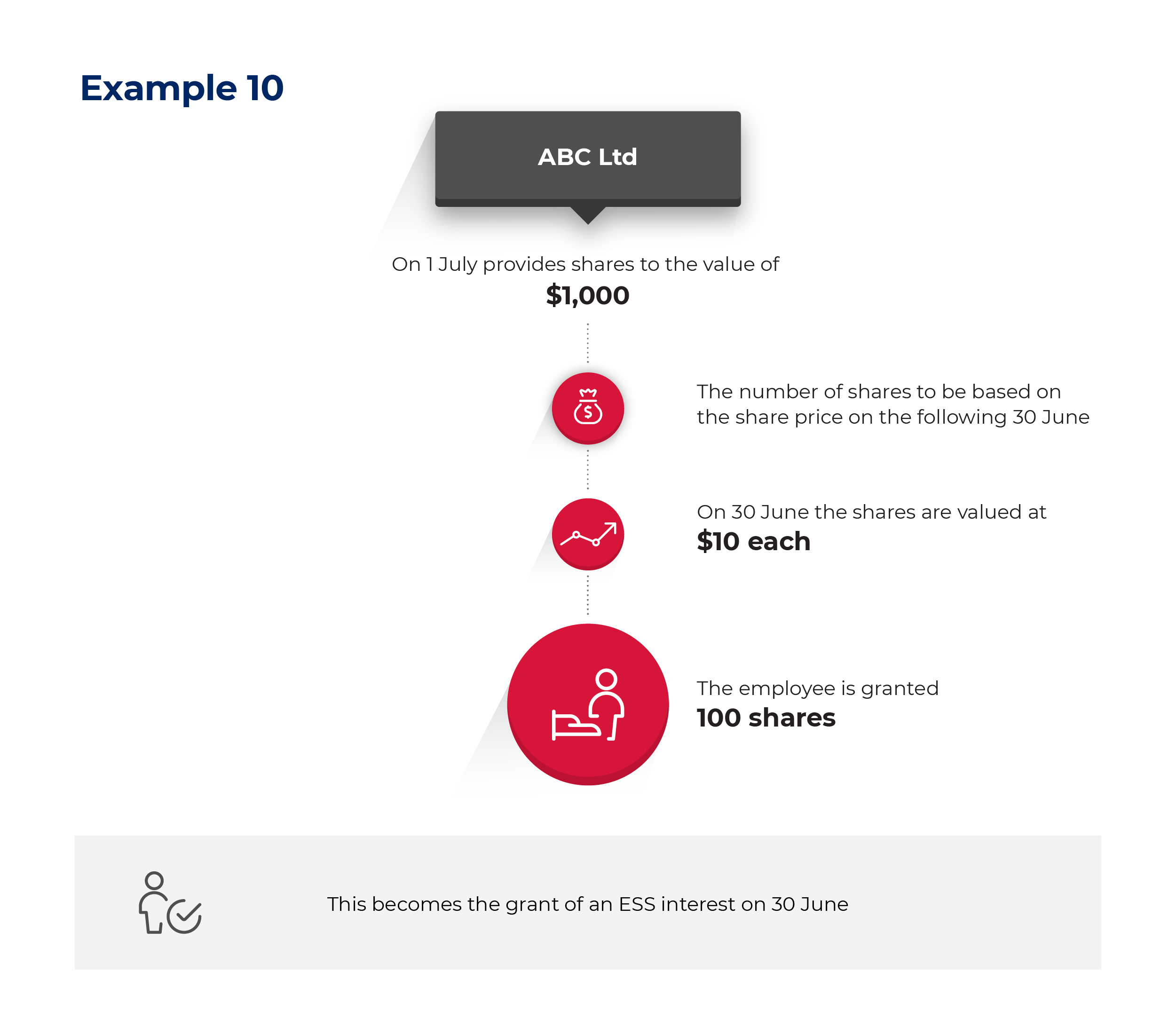

Example 10.1

At the beginning of the financial year (1 July), ABC Ltd decides to provide an employee with shares in the Company to the value of $1,000, based on the share price at the end of the financial year. At the end of the financial year (30 June) the shares are valued at $10 each, and the employee is granted 100 shares. This becomes the grant of an ESS interest on 30 June.

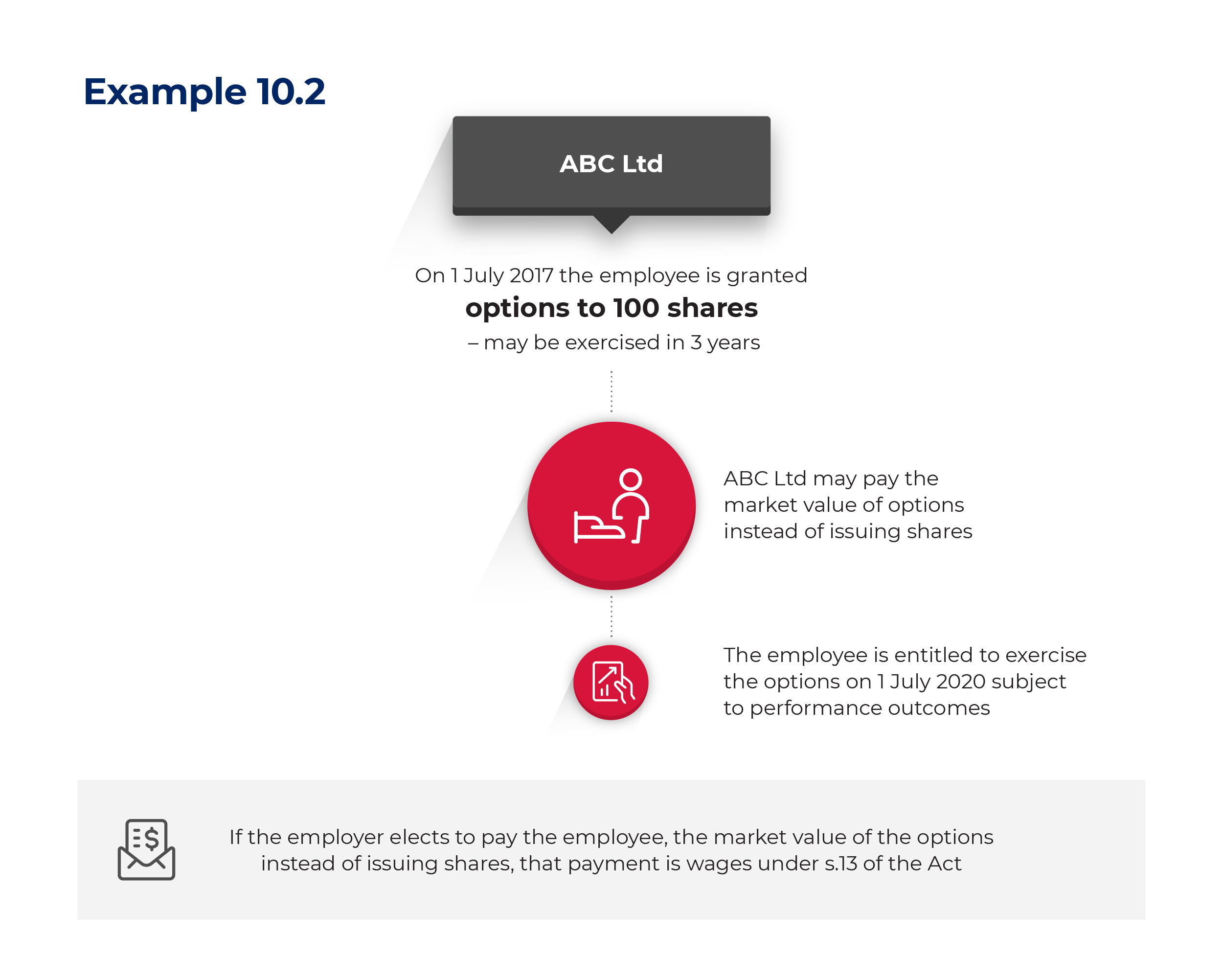

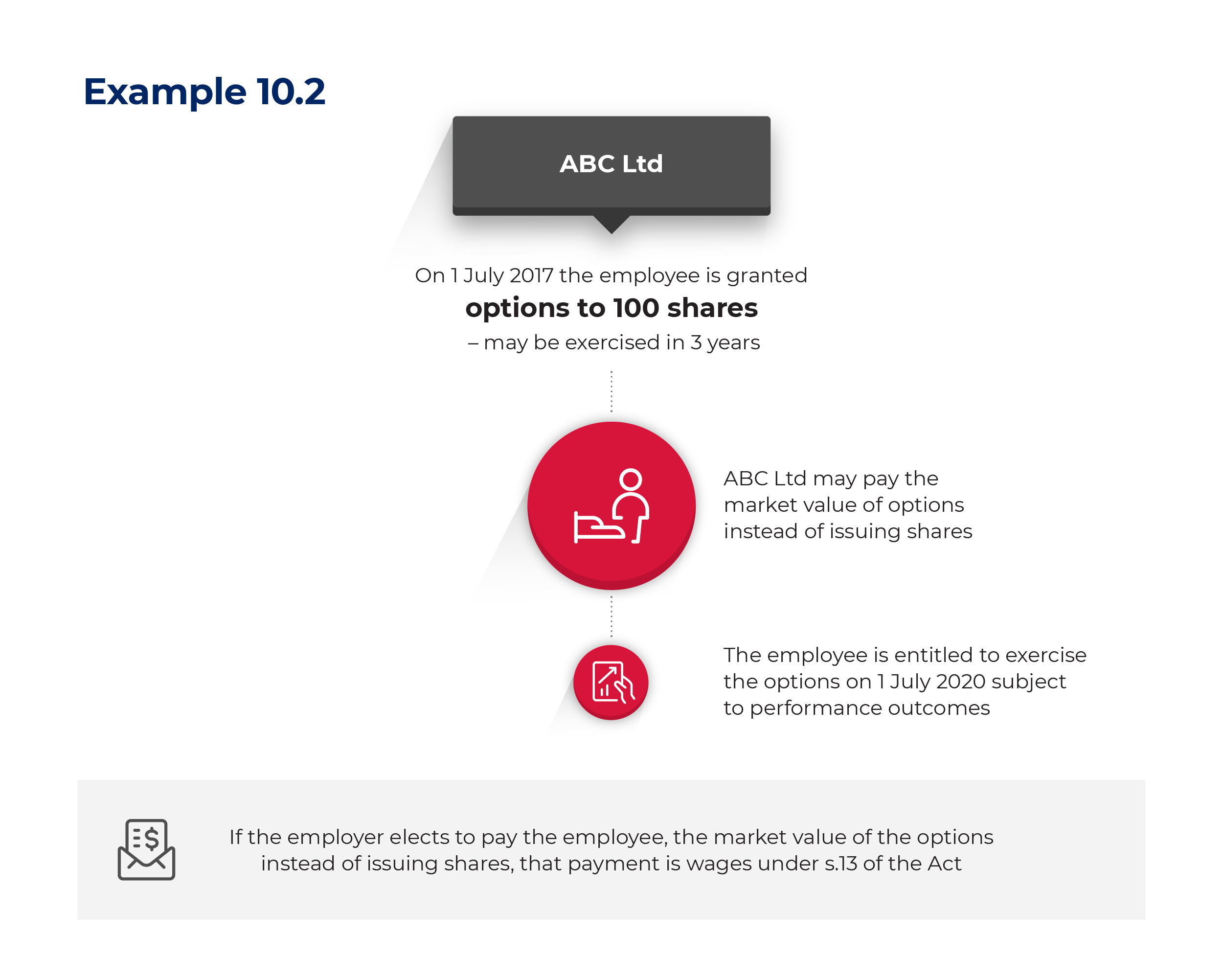

Example 10.2

On 1 July 2017, ABC Ltd agrees to grant an employee options of 100 ABC Ltd shares, subject to performance conditions. The employee is entitled to exercise the options 3 years later, on 1 July 2020, if the employee is still employed and achieves specified performance targets. However, ABC Ltd may “cash-settle” the options, meaning that upon exercise by the employee, ABC Pty Ltd may choose to pay a cash amount to the employee, equal to the market value of the options, instead of issuing shares.

The options are indeterminate rights on 1 July 2017, because they have not been “granted” [see s.19(2A) of the Act]. Therefore, the employer cannot choose to pay tax at that time.

If the employee, having achieved the performance criteria, elects to exercise the options on 1 July 2020, and the employer elects to issue the shares, the options are considered to be a grant of an ESS interest on the day the employer makes that election. The options also vest on that day [see s.19(4) of the Act].

If the employer elects to pay the employee the market value of the options instead of issuing shares, there is no grant of an ESS interest, but the payment to the employee of the market value of the options is wages under s.13 of the Act.

11. Withdrawal, cancellation or exchange of an ESS interest

Where the grant of an ESS interest is withdrawn, cancelled or exchanged before the vesting date and the employer provides valuable consideration to the recipient as compensation, other than consideration in the form of another share or option, the ESS interest is deemed to have vested on the date of withdrawal, cancellation or exchange. If the employer chose to pay tax on vesting, the taxable value of the ESS interest is the value of the consideration provided by the employer. If the employer paid the payroll tax when granted, no adjustment is required.

Example 11

ABC Ltd grants 1,000 options to an employee for no consideration. The options are valued at $5,000 on the date of the grant. The company elects to pay tax on vesting, which is the date on which the options are exercised.

Before the employee exercises the options, the company is taken over by XYZ Ltd, and the options are cancelled. The employee is paid $1,000 by ABC Ltd as compensation.

The options in ABC Ltd are deemed to have vested on the date they are cancelled, and the taxable value is $1,000, which is the value of the options on the day they are cancelled.

12. ESS interests which are forfeited or lapse

An ESS interest may be granted subject to conditions, such as performance targets, length of service or continuation of employment. When such conditions apply to the grant, vesting does not occur unless or until the conditions are met or waived by the employer.

Where an employer has chosen to pay tax on the grant of an ESS, and the grant is rescinded before the vesting date (because the vesting conditions are not met), the employer may reduce taxable wages in its return for the month or financial year in which the forfeiture or rescission occurs. The reduction in taxable wages allowed is the amount declared on the grant of the ESS.

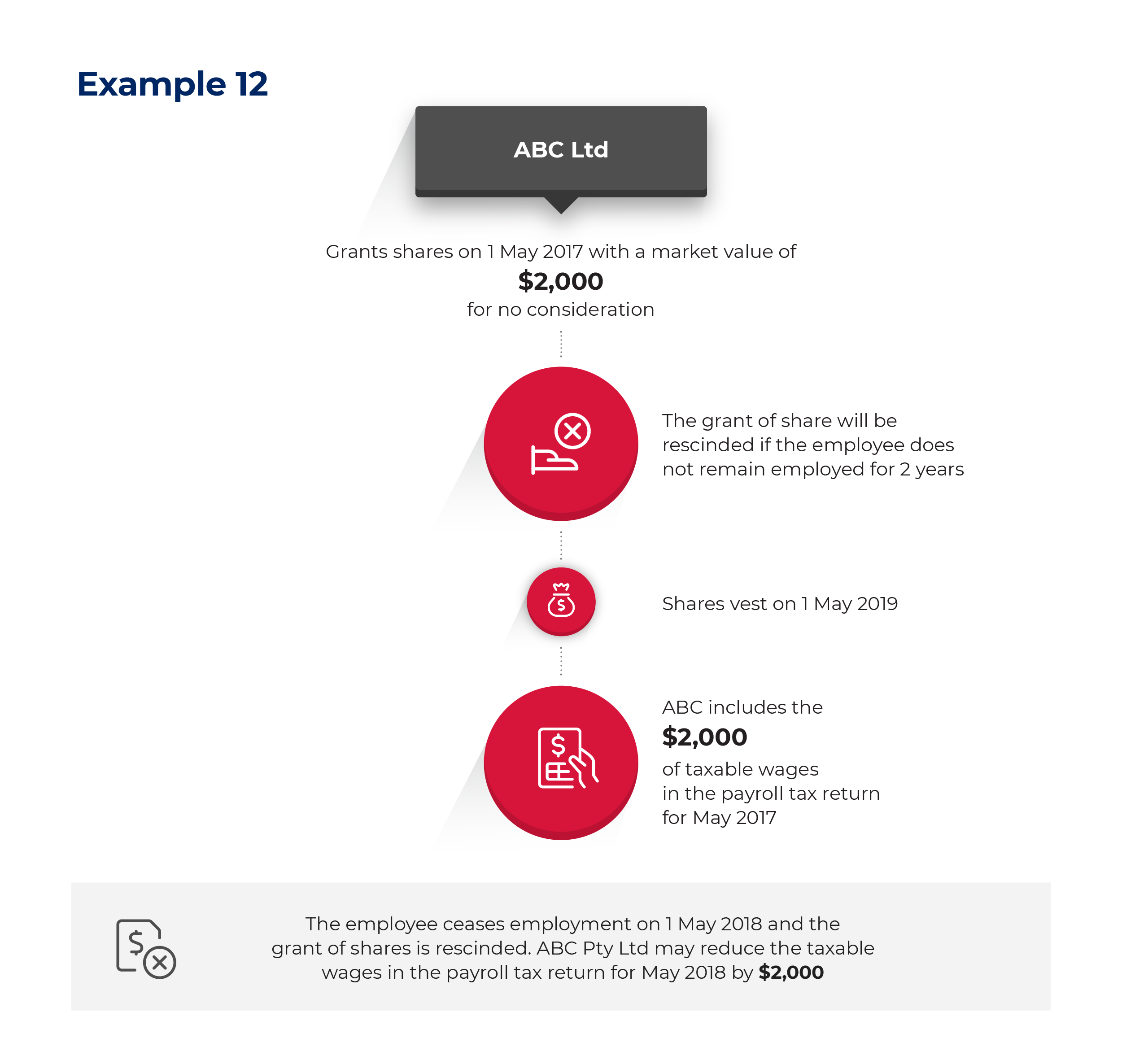

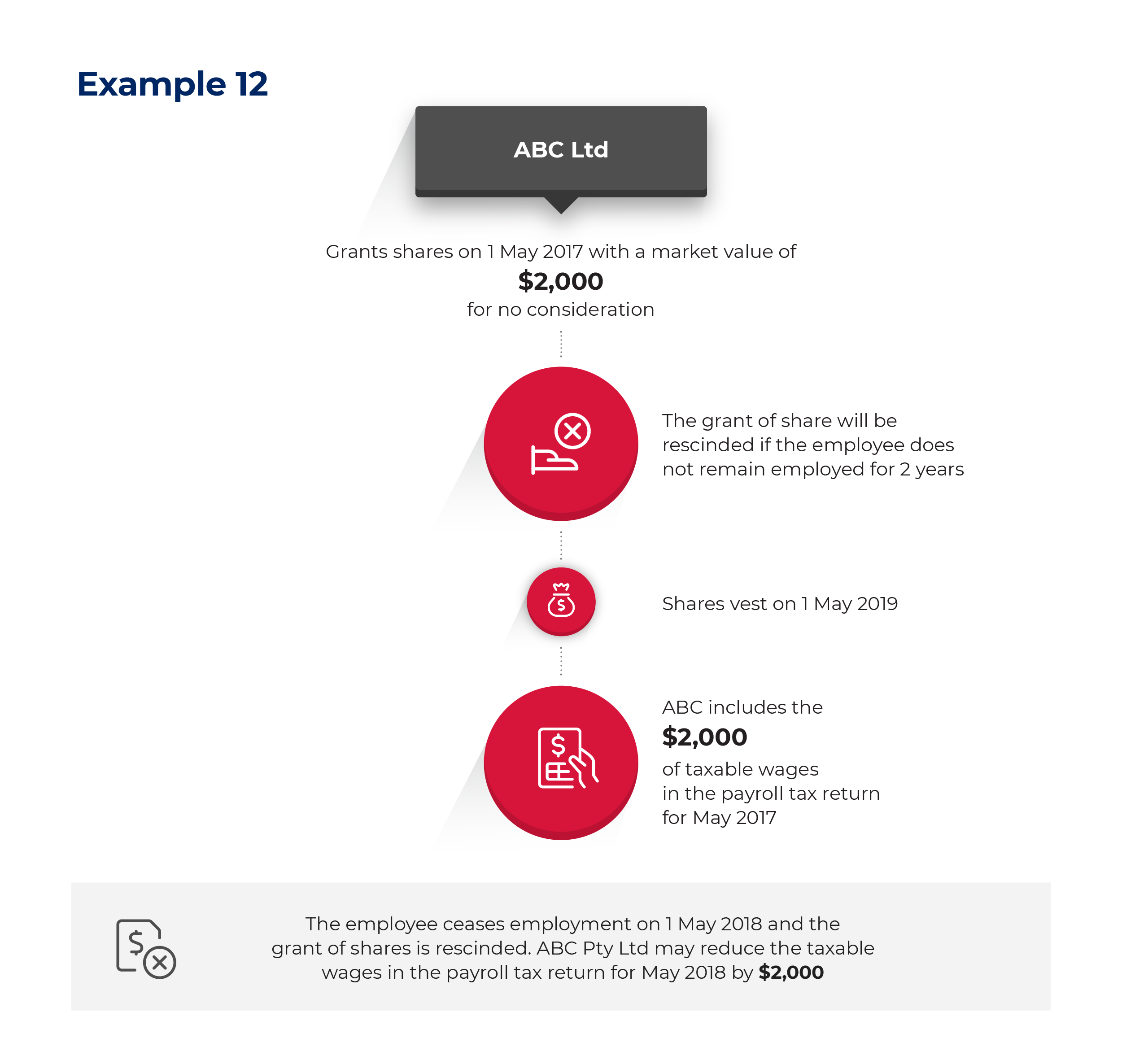

Example 12

ABC Ltd grants shares to an employee on 1 May 2017. The market value of the shares on the grant day is $2,000 and the employee is not required to pay any consideration for them. The grant of the shares will be rescinded if the employee does not remain employed for 2 years. The shares will vest on 1 May 2019, provided the employee continues to be employed until that date.

ABC Ltd elects to return the value of the shares at the grant date and includes the $2,000 of taxable wages in its payroll tax return for May 2017.

The employee ceases employment after 1 year with ABC Pty Ltd on 1 May 2018, and the grant of the shares is therefore rescinded. ABC Pty Ltd may reduce its taxable wages in its payroll tax return for May 2018 by $2,000.

However, if an employer elects to pay payroll tax on the grant of an option, and the employee simply does not exercise the option, the employer is not entitled to reduce its taxable wages by the value of the options on which it paid tax.

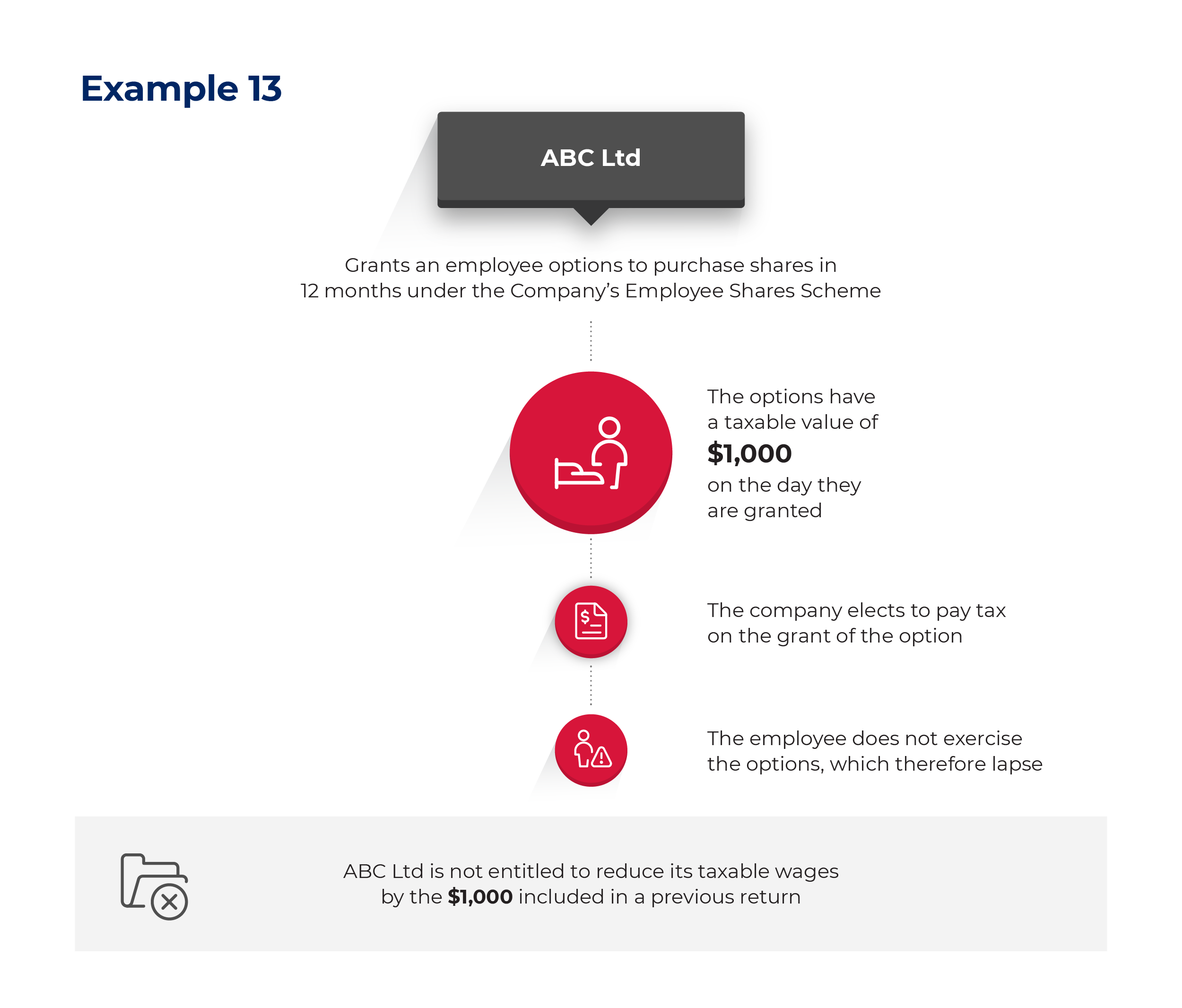

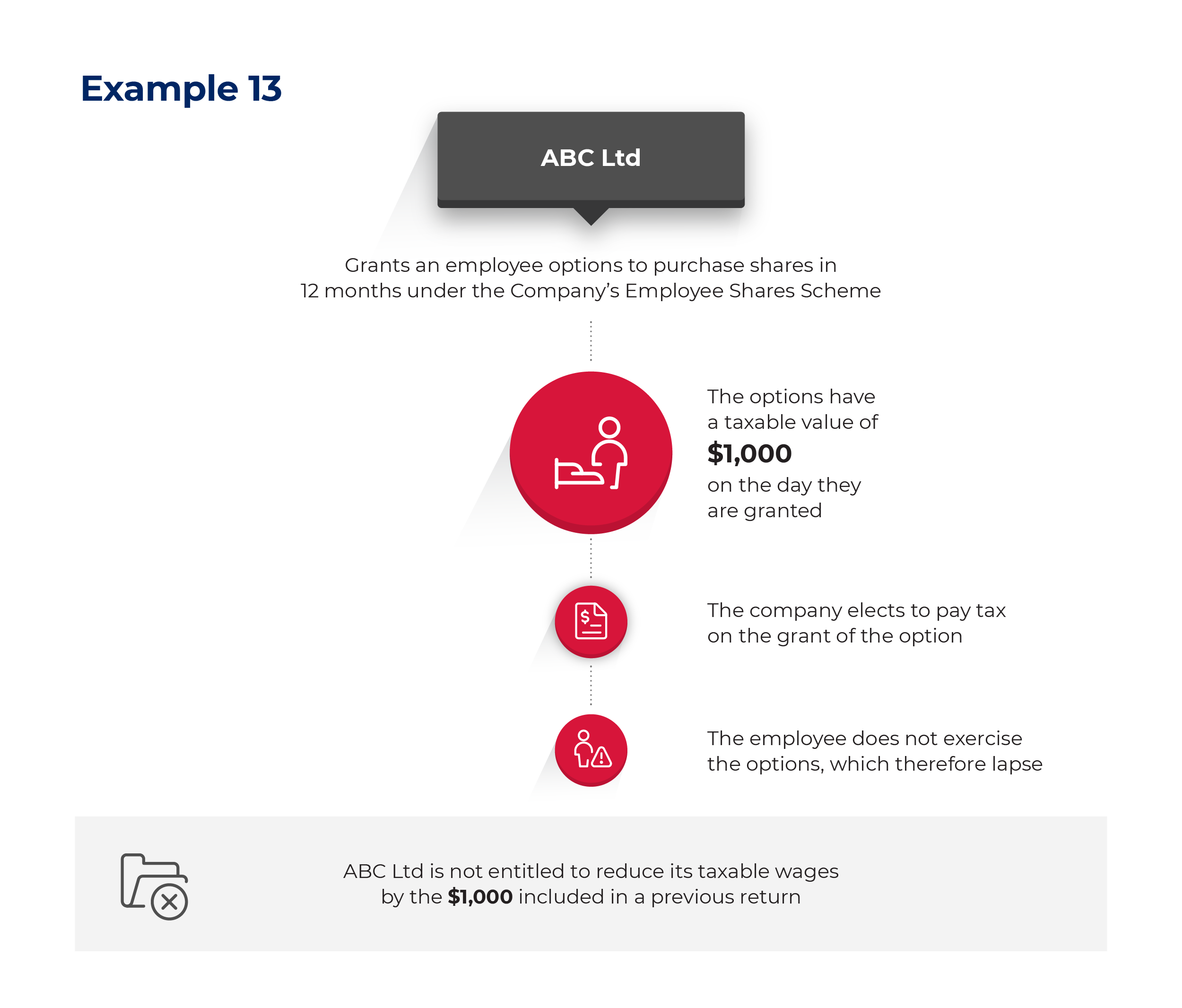

Example 13

ABC Ltd grants an employee options to purchase shares in 12 months’ time under the Company’s Employee Shares Scheme. The options have a taxable value of $1,000 on the day they are granted. The company elects to pay tax on the grant of the options and includes the $1,000 in its next payroll tax return.

In 12 months’ time the exercise price falls below the value of the shares, so the employee does not exercise the options, which therefore lapse. ABC Ltd is not entitled to reduce its taxable wages by the $1,000 included in a previous return.

13. Application of nexus provisions to an ESS interest

Nexus provisions in the payroll tax legislation of each state and territory are identical, and ensure that wages, including ESS interests, are only taxable in 1 state or territory.

If an employee performs services wholly in NSW during a calendar month, wages paid or payable, including the grant of an ESS interest under an employee share scheme, are taxable in NSW.

If, during a month, an employee performs services in NSW and also in another state or territory, or in another country, Revenue Ruling PTA 039 explains how to determine the Australian State or Territory in which an ESS interest (as well as other forms of wages), may be subject to payroll tax.

14. ESS interest granted by a parent company that is not the employer

If a parent company grants an ESS interest to an employee of a subsidiary under the group employee share scheme, the subsidiary company may be liable for payroll tax by application of s.46 (“Wages paid by or to third parties”), even though the parent company provided the ESS interest. The parent company is not liable.

Example 14

George works for ABC Pty Ltd, which is a subsidiary of ABC Ltd.

The parent company, ABC Ltd, grants shares to George under the group’s employee share scheme.

The shares have a taxable value when granted, and also on vesting.

ABC Pty Ltd is liable for payroll tax under s.46(1)(a) on grant or vesting, whichever “relevant day” is chosen.

The parent company, ABC Ltd, is not liable.

Other remuneration related to shares or options

1. Dividend equivalent schemes

A scheme under which employees or directors are entitled to a cash payment equivalent to the dividends payable on a specified number of shares in the company is not an ESS interest under an Employee Share Scheme.However, any such payments are wages under s.13(1) of the Act (“What are wages?”).

2. Stock appreciation rights or benefits

Stock appreciation rights or benefits provided to employees or directors offer the right to the cash value of any increase in the value of shares over a predetermined time period. The entitlement may be subject to conditions, including performance benchmarks.;This type of payment is not an ESS interest but is subject to payroll tax under the definition of “wages” in s.13 of the Payroll Tax Act (“What are wages?”).

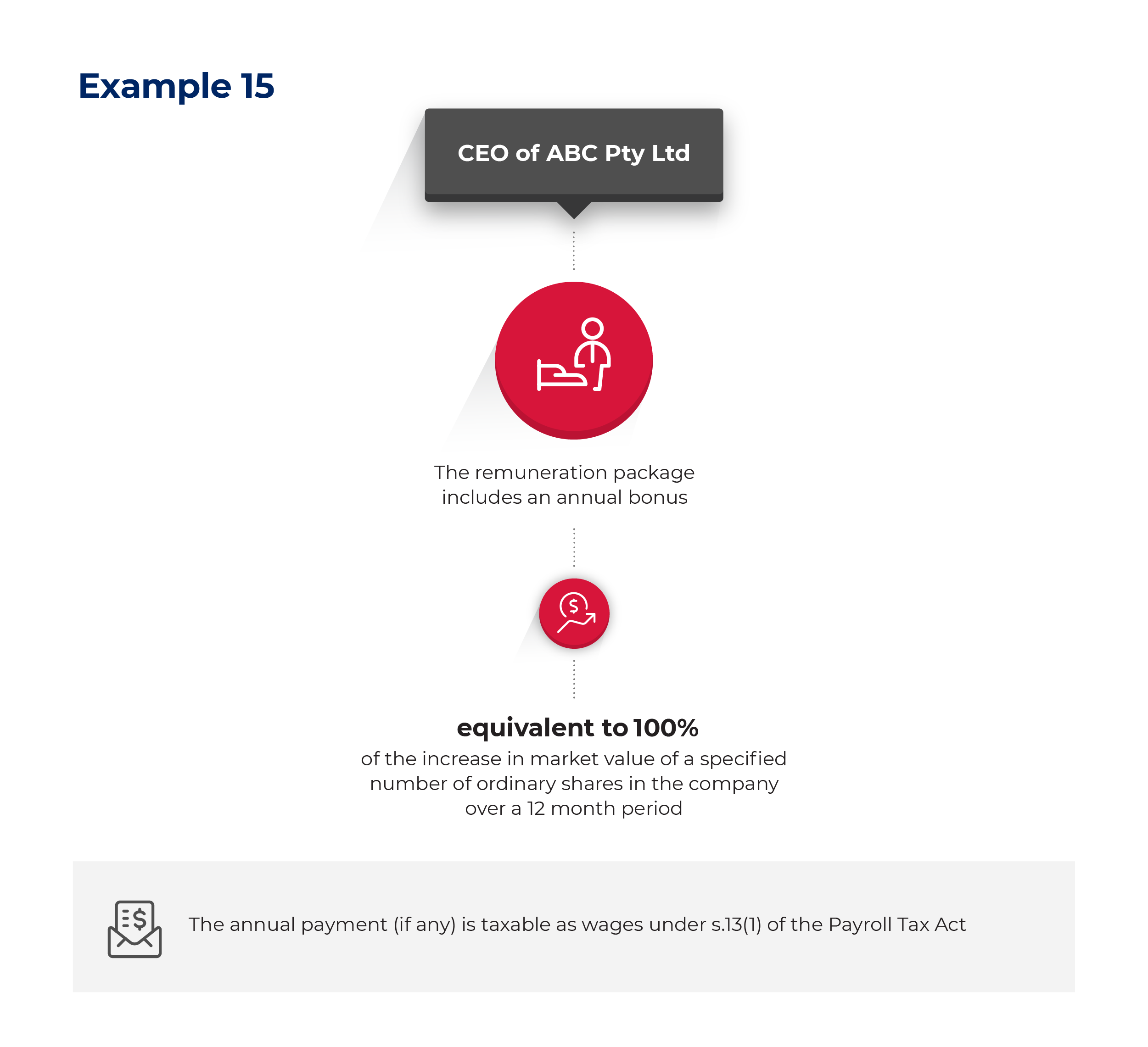

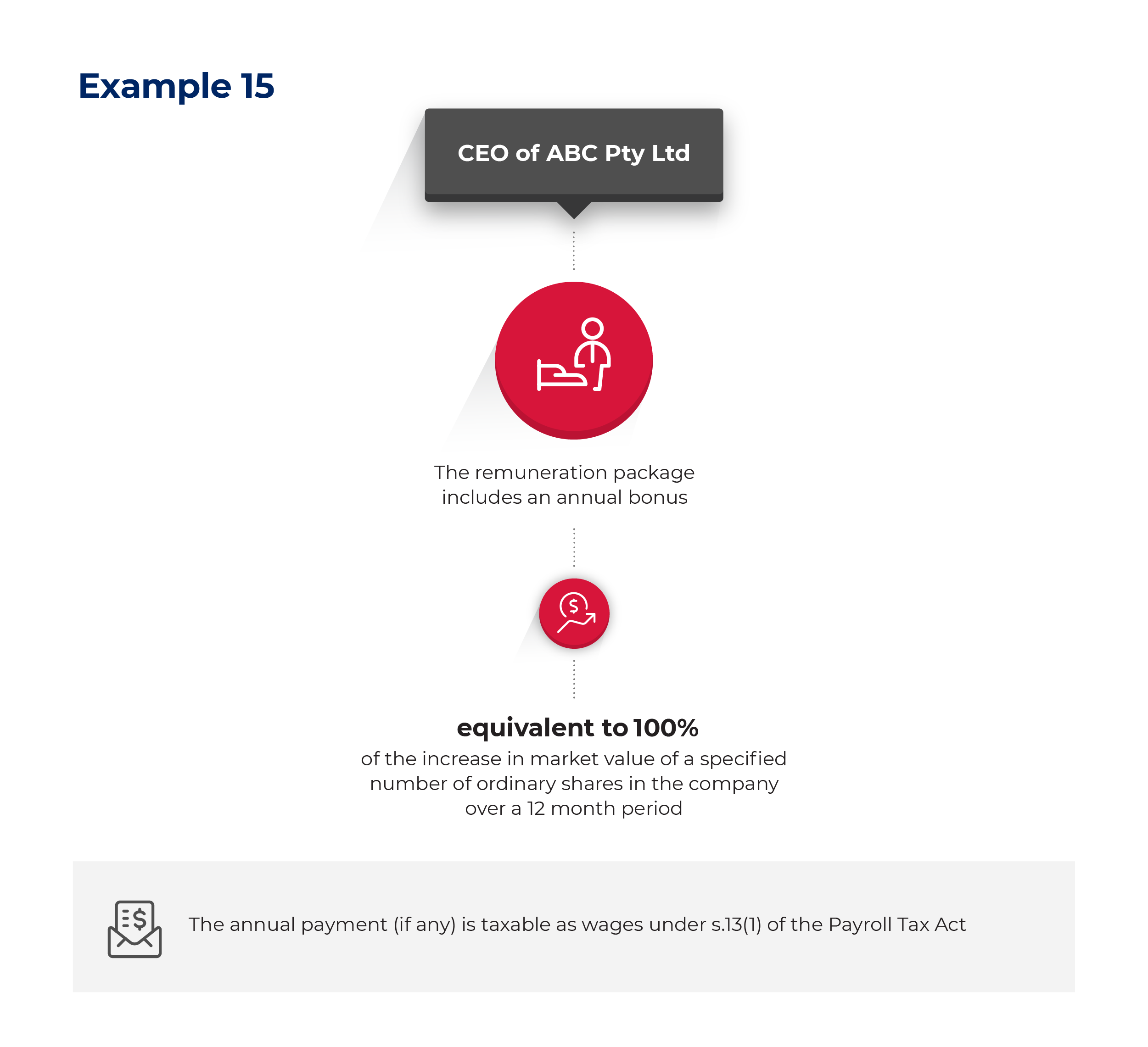

Example 15

The remuneration package of the Chief Executive Officer of ABC Pty Ltd includes an entitlement to an annual bonus equivalent to 100% of the increase in market value of a specified number of ordinary shares in the company over a 12-month period. If the shares do not increase in value, no bonus is paid.

The value of the annual bonus is taxable under s.13(1) of the Payroll Tax Act.

3. Payments in the form of an ESS interest under a relevant contract

Amounts paid or payable under a relevant contract for or in relation to the performance of work are taken to be wages under s.35 of the Payroll Tax Act. If the consideration payable to a person who is taken to be an employee under a relevant contract includes rights to shares or options, the value of the shares or options is subject to payroll tax under s.35 (“Amounts under relevant contracts taken to be wages”).

Employers may value such shares or options using the methodologies that may be used in the case of an ESS interest under an employee share scheme.

4. Other equity-based interests in foreign entities

If an employee or deemed employee receives remuneration in the form of an equity interest in a foreign entity that is neither a share nor an option, (eg. a membership interest), it is not taxable as an ESS interest. However, the value of that interest is liable to payroll tax under section 13 (wages) or section 35 (relevant contracts) of the Payroll Tax Act.

Conversion of foreign currency

In cases where the value of shares or options that are subject to payroll tax are calculated in a foreign currency, the taxable value must be converted to Australian currency.

Employers may use either of the following rates:

- the Reserve Bank of Australia's daily rate published for the day on which the shares or options are deemed to have been paid or payable, or

- the yearly average rate for the relevant financial year, as published by the Australian Taxation Office (ATO) can be applied for the purposes of making monthly returns, but the current year’s rate must be used to make an adjustment in the annual reconciliation (see Revenue Ruling PTA 039 Nexus Provisions, under the heading “Wages paid in a foreign currency”..