Commissioner's Practice Note 009: Payroll tax grouping

This practice note explains the different ways businesses and other entities may be grouped for payroll tax, including examples.

| Practice Note number |

CPN 009

|

|---|

| Tax/benefit |

Payroll Tax

|

|---|

| Type |

Grouping

|

|---|

| Date issued |

August 2019

|

|---|

| Issued by |

Jane Dudley

Commissioner of State Revenue

|

|---|

| Status |

Current

|

|---|

Aim

This Commissioner’s Practice Note is relevant to all businesses that may be grouped with other businesses under Part 5 (Grouping of employers) of the Payroll Tax Act 2007 (the Act).

A group of employers is entitled to claim a single threshold deduction between them. This practice note will assist customers to decide whether they are members of a group, and whether they may be entitled to be excluded from the group.

Note: Businesses must advise the Chief Commissioner they are part of a group. Failure by customers to advise the Chief Commissioner that they are members of a group may result in a tax default by all members of the group, and could result in interest and penalty tax being imposed.

This practice note explains:

- How corporations that are related within the meaning of s.50 of the Corporations Act 2001 (Cth) are grouped, and are not able to be excluded from the group.

- How businesses can be grouped where an employee performs duties for another business.

- How a person, or persons together, have a controlling interest in a business.

- How an entity has a controlling interest in a corporation under the tracing provisions.

- When groups are amalgamated to form a larger group.

- The implications of grouping for interstate employers.

- How the discretion to exclude a member from a group is applied.

Purpose of the grouping provisions

The grouping provisions were introduced in 1975 to combat a tax avoidance practice of creating multiple entities to employ workers engaged in a single business or enterprise, allowing each entity to claim a separate threshold. The grouping provisions prevent groups of commonly controlled businesses from claiming multiple thresholds. However, the provisions may apply even though avoidance of payroll tax was not one of the purposes of establishing any of the members of a group.

How are employers grouped?

Groups may arise in the following circumstances:

- Corporations are related bodies corporate within the meaning of the Corporations Act 2001 (Cth); or

- The use of common employees; or

- Common control of businesses by the same person or set of persons; or

- Tracing of interests in corporations.

Groups of employers may include individuals, corporations, partnerships and trustees.

A person who is not an employer may be part of a group even though the business has no employees and does not make any payments that are taxable “wages” as defined in the Act; (see Edgely Pty Ltd v CCSR [2015] NSWCATAD 16).

Extended meaning of “business”

A person may be considered to be conducting a business for grouping purposes even if its activities do not satisfy the ordinary or accepted definition of a “business”. The ordinary meaning of a “business” is an activity or enterprise carried on for profit or gain on a continuous or repetitive basis. The Act extends this ordinary meaning to include a number of activities or circumstances that are not usually regarded as a business, including:

- any activity carried on for fee, gain or reward, such as the leasing of a property;

- employing a person to work in or in connection with another business; for example, a family company may engage a family member to work for another business;

- carrying on a trust, including a dormant trust;

- an example of “carrying on a trust” is a bare trust under which the trustee’s only active duties are to hold assets and deal with the assets in accordance with directions given by the beneficiary;

- an example of a dormant trust is a trust that does not conduct any transactions.

- holding money or property in connection with another business, for example where a person (which may be an individual or a corporation) is the owner of a building which is used in a business conducted by another person (who may be either an individual or a corporation).

(see Edgely Pty Ltd v CCSR [2015] NSWCATAD 16).

Methods of grouping persons

Grouping of “related corporations” – s.70

Corporations are grouped under s.70 of the Act if they are related bodies corporate within the meaning of s50 of the Corporations Act 2001 (Cth). This is commonly described as a holding/subsidiary relationship.

A corporation will be grouped with another corporation for the purposes of s.70 if it:

- controls the composition of the board of directors of that other corporation, or

- can cast, or control the casting of, more than 50 % of the votes which can be cast at a general meeting of that other corporation; or

- holds more than 50% of the issued share capital (excluding certain shares with limited rights).

A group created by this provision includes those corporations in a direct holding/subsidiary relationship as well as those corporations which have:

- a common holding company, or

- a common ultimate holding company.

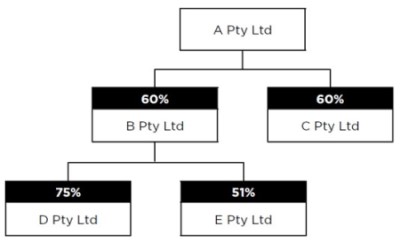

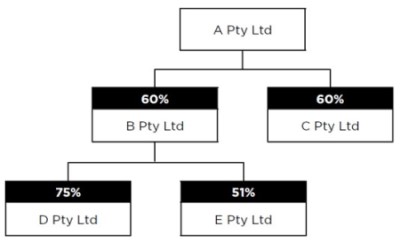

A Pty Ltd is the holding company of both B Pty Ltd and C Pty Ltd because it holds more than 50% of the issued shares of each company. B Pty Ltd is the holding company of both D Pty Ltd and E Pty Ltd.

All of the companies constitute a group. A Pty Ltd is the common ultimate holding company.

A group under this section is a mandatory group. This means the Chief Commissioner cannot exclude a corporation from such a group, even if the business carried on by a member of the group is independent of, and not connected with, any of the businesses carried on by any other corporation in the group.

This grouping provision applies to corporations regardless of where in Australia or overseas they are registered or where they carry on a business. It is important for an Australian subsidiary of an overseas parent corporation to be aware of this grouping provision. It may apply to group Australian subsidiaries of the same overseas corporation even if the overseas corporation does not pay any wages that are liable to payroll tax in Australia. The provision applies even if the Australian subsidiaries who are grouped are unaware that they are related because they have a common overseas holding company.

For this reason, a corporation owned by an overseas parent corporation should establish whether there are other related subsidiaries operating in Australia, eg by contacting the parent company.

Grouping resulting from use of common employees – s.71

An employer who carries on a business may be grouped with another person(s) carrying on another business or businesses where:

- S.71(1): One or more employees of the employer perform duties for one or more businesses carried on by that employer together with another person(s).

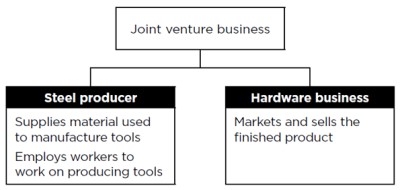

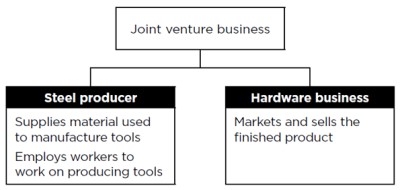

A steel producer and a hardware business form an unincorporated joint venture business to conduct a single business producing and selling tools.

The steel producer supplies the tool business with the steel used to manufacture tools and employs the workers who work on the tool production line. The hardware business markets and sells the finished product.

The steel producer and the hardware business are grouped under s.71(1) due to the use of the steel producer’s employees in the joint venture business.

- S.71(2): One or more employees of the employer are employed solely or mainly to perform duties for one or more businesses carried on by one or more other persons.

A white goods wholesaler sells its products to retailers who operate under franchise agreements with the wholesaler.

The wholesaler employs clerical staff who work in each franchisee’s business under the direction of the franchisee maintaining stock, including managing orders of goods from the wholesaler.

The wholesaler and each of the franchisees are grouped under s.71 because an employee of the wholesaler is working mainly in each franchisee’s business.

Franchise agreement with retailers

Wholesaler provides clerical staff for each retailer to maintain stock, manage orders etc.

- S.71(3): One or more employees of an employer performs duties for or in connection with one or more businesses carried on by one or more other persons, being duties performed in connection with, or in fulfilment of the employer’s obligation under an agreement, arrangement or undertaking for the provision of services to any of those persons.

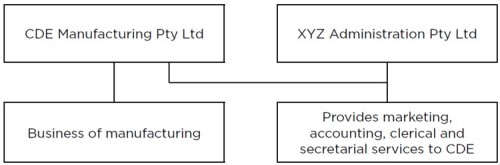

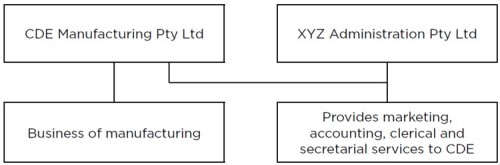

CDE Manufacturing Pty Ltd is a manufacturer. XYZ Administration Pty Ltd provides marketing, accounting, clerical and secretarial services to CDE.

In providing those services, the employees of XYZ are under the direction and control of CDE managers. CDE and XYZ constitute a group under s.71(3) because the employees of XYZ perform duties for or in connection with CDE’s business.

Note

CDE and XYZ constitute a group because the employees of XYZ perform duties for, and under the direction of CDE.

In examples 3 and 4 the workers employed by one business performs duties in the other business in an employee-like manner, rather than just providing services for the other business (see Commissioner of State Revenue v Liquid Rock Constructions Pty Ltd [2012] VSC 329).

In both examples managers of the other business are able to exercise control, directly or indirectly, over the way in which the employee performs those duties (see Regis Mutual Management Pty Ltd v Chief Commissioner of State Revenue [2015] NSWCATAD 213).

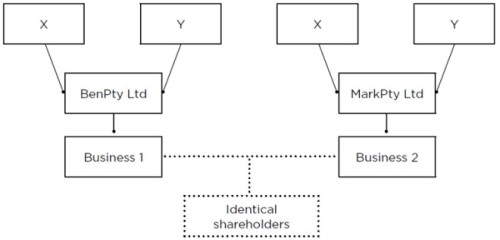

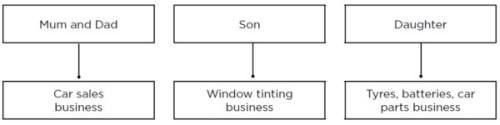

Grouping of commonly controlled businesses – s.72

A group exists where the same person or set of persons has a controlling interest in each of two businesses [see s.72(1)]. The meaning of a “controlling interest” is defined in s.72, and varies depending on the type of entity conducting the business.

The following provisions identify the person (or persons together) who have a “controlling interest” in businesses carried on by:

- sole owners, including natural persons, corporations and trustees [see s.72(2)(a) & s.72(2)(b)],

- corporations [see s.72(2)(c), s.72(2)(e) & s.72(3)],

- incorporated and unincorporated bodies [see s.72(2)(d)],

- partnerships [see s.72(2)(f)],

- trustees [see s.72(2)(g), s.72(5), s.72(6), s.72(7) & s.72(8)].

In addition, under s.72(4) any person (or persons together) who have a controlling interest in a business under any of these paragraphs, is (or are) grouped with the person that conducts the business, if the person who conducts the business has a controlling interest in another business.

Sole owners (applies to individuals, corporations and trustees) [s.72(2)(a) & (b)]

Where a business is conducted by a person who is the sole owner of the business, that sole owner has a controlling interest in the business. A sole owner can be a natural person or a corporate body, and may own the business as trustee of a trust.

Where 2 or more trustees are the sole owners of a business as joint trustees of a trust, the trustees together have a controlling interest in the business. This only applies where the trustees are joint trustees of the same trust. It does not apply if the trustees act for different trusts.

Where two businesses are owned by the same person, acting in the same capacity, there is no need to consider the application of the grouping provisions. In such cases, there is only one employer and the wages paid for each business must be included in a single return lodged by that employer. For example:

- separate businesses or branches of a single business are owned by the same company; or

- a trustee owns two businesses on behalf of the same trust.

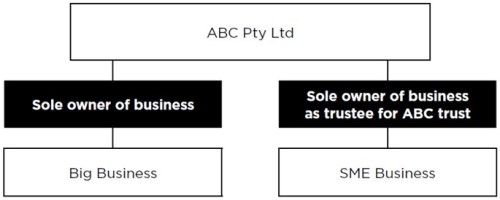

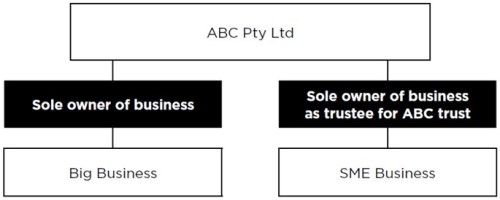

ABC Pty Ltd is the owner of a business in its own right and is also the owner of another business carried on under the ABC trust. If taxable wages are paid in both businesses, ABC Pty Ltd must lodge 2 returns, one for each business.

Although ABC Pty Ltd has a controlling interest in both businesses (because it is the sole owner of both), it is the owner of each business in a different capacity.

Therefore, grouping would not apply under ss.72(2)(a) or (b). However grouping may apply under s.71 if an employee working in the Company’s business performs duties for the trust business.

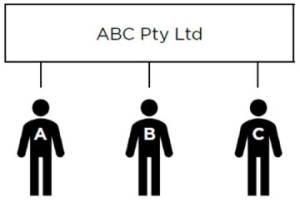

Corporations (excluding trustee companies) [s.72(2)(c)]

The following person or persons together have a controlling interest in a business carried on by a company (these provisions do not apply to a business carried on by a company as trustee):

- A director or 2 or more directors who together can exercise more than 50% of the voting power at a directors’ meeting (s.72(2)(c)(i).

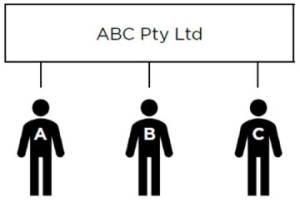

A, B and C are the only directors of ABC Pty Ltd and have equal voting rights at a directors’ meeting. The combinations of persons who each have a controlling interest in ABC Pty Ltd’s business are:

- A & B,

- A & C,

- B & C,

- A, B & C.

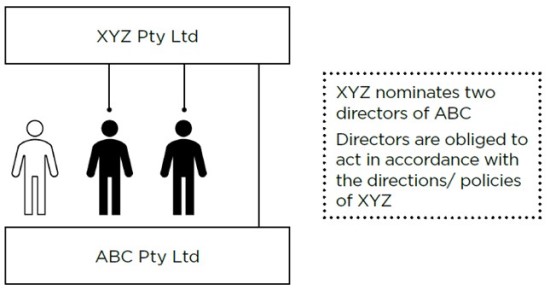

- A person or persons who can control the voting power of more than 50% of the voting power at a meeting of directors (s.72(2)(c)(ii)); this provision applies to “shadow directors”.

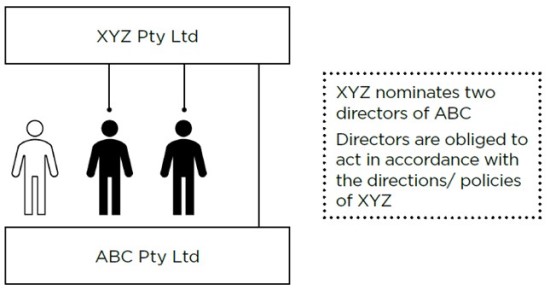

Under the constitution of ABC Pty Ltd, XYZ Ltd has the right to nominate 2 of the 3 directors of ABC Pty Ltd. Each director of ABC Pty Ltd has equal voting rights at a directors’ meeting.

The directors nominated by XYZ Ltd are obliged to act in accordance with directions or policies of XYZ Ltd.

XYZ Ltd has a controlling interest in ABC Pty Ltd’s business; in addition, the 2 directors nominated by XYZ together have a controlling interest in ABC Pty Ltd’s business.

Note

XYZ Ltd has a controlling interest in ABC’s business. The 2 directors nominated by XYZ together also have a controlling interest in ABC’s business

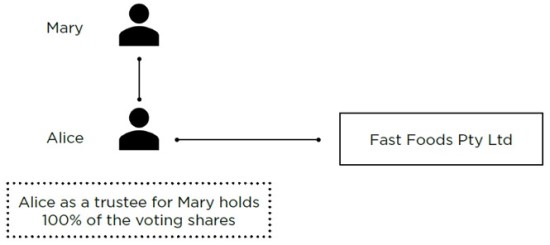

- A shareholder or any other person who can exercise or substantially influence the exercise of more than 50% of the voting power attached to any class of issued voting shares of the corporation (s.72(2)(e)).

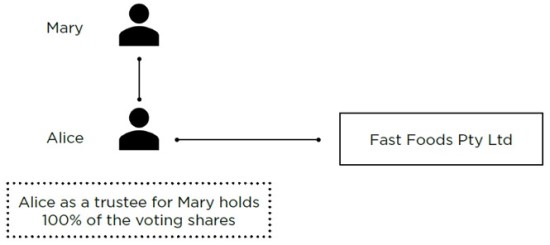

Alice owns 100% of the voting shares in Fast Foods Pty Ltd, on trust for Mary. The terms of the trust deed require Alice to vote in accordance with instructions from Mary.

Mary has a controlling interest in the company’s fast foods business because she can substantially influence the way Alice votes. Alice also has a controlling interest because she actually exercises the voting power attached to her shares.

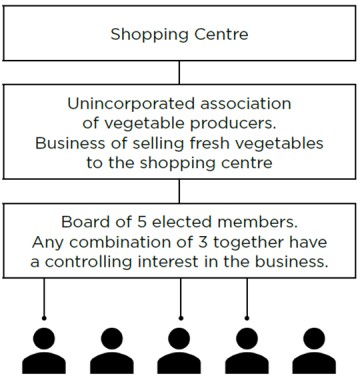

Incorporated and unincorporated bodies [s.72(2)(d)]

A person or a set of persons together have a controlling interest if the person or persons constitute more than 50% of the Board of Management or controlling body of a body corporate (e.g. the Board of Directors of a company) or of an unincorporated body.

This provision applies also to a person or persons who can control the composition of the board or controlling body.

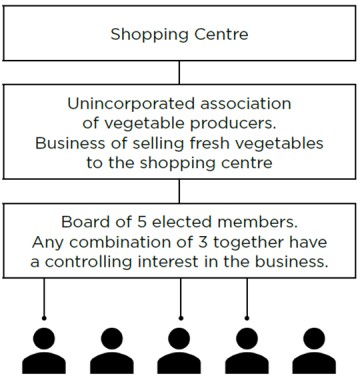

An unincorporated association of vegetable producers conducts a business of selling fresh vegetables to a shopping centre. The board which manages the business consists of 5 elected members. Any combination of 3 or more of the board members together have a controlling interest in the business because they constitute more than 50% of the board.

Partnerships [s.72(2)(f)]

In the case of a partnership business, a partner has controlling interest in the business if that partner either:

- owns more than 50% of the capital of the partnership, whether beneficially or not; or

- is entitled to more than 50% of the profits of the partnership.

If 2 or more of the partners together satisfy either of these tests, those partners together have a controlling interest in the partnership business.

This provision applies to partnerships even if any 1 or more of the partners are incorporated bodies or are acting in the capacity of trustee. The grouping provisions in s.72 applying exclusively to corporations or trusts do not apply to a business carried on by a partnership.

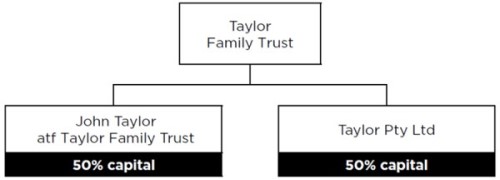

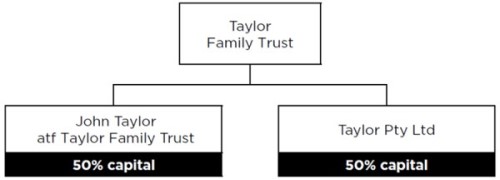

John Taylor atf the Taylor Family Trust and Taylor Pty Ltd are partners in the Taylor Family Partnership business. Each owns 50% of the capital.

The partners together have a controlling interest in the partnership business under ss.72(2)(f) because together they own 100% of the capital.

Note

The Taylor Family Partnership business is carried on by a partnership, and the persons who have a controlling interest in the business are determined under s.72(2)(f). Even though one of the partners is a corporation, the business is not conducted by a corporation and therefore s.72(2)(c) does not apply. Nor does s.72(2)(g) apply, even though 1 of the partners is a trustee, because the business is not conducted on behalf of a trust.

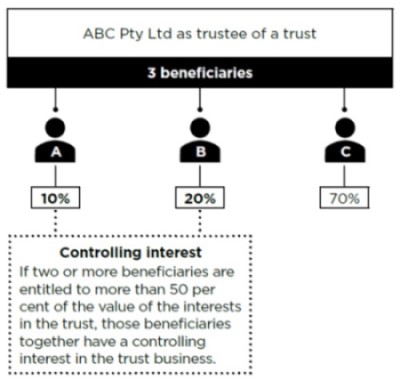

Control of a trust business [s.72(2)(g) & 72(6)]

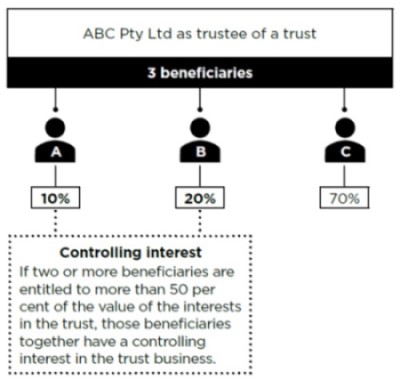

Where a business is conducted by a trustee on behalf of a trust, a beneficiary of the trust who is entitled to more than 50% of the value of the interests in the trust has a controlling interest in that business. Any 2 or more beneficiaries who are entitled to more than 50% of the value of the interests in the trust together have a controlling interest in the trust business. The “value of interests” in a trust include the proportion of profits and capital distributions to which a beneficiary is entitled.

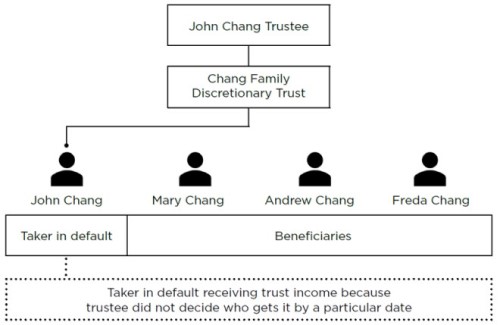

Any person who may benefit from a discretionary trust is deemed to be a beneficiary of more than 50 per cent of the value of the interests in the trust and therefore has a controlling interest in that trust. A person who is a “taker in default” may benefit from a discretionary trust, and is therefore taken to be a beneficiary.

A hybrid trust is treated as a discretionary trust if the trustee or any other person has a discretionary power to determine who receives any part of an income or capital distribution even if the trust deed specifies fixed distributions of part of the capital or income, or both.

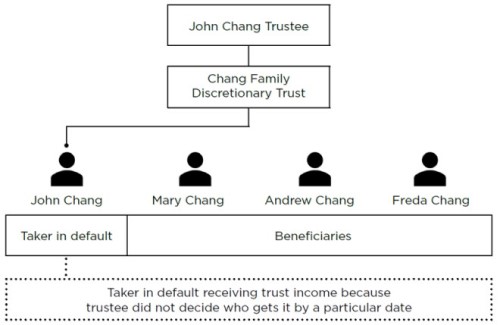

John Chang conducts a business as trustee for the Chang Family Trust. The trust is a discretionary trust. The trustee has discretion to appoint Mary Chang and her 2 children, Andrew and Freda, as recipients of capital or income distributions.

If the trustee does not decide which beneficiaries receive income of the trust for a particular year, John Chang is entitled to that income as “taker in default”.

John (as “taker in default”), Mary, Andrew and Freda may benefit from the trust. Therefore, each of them has a controlling interest in the business of the trust. In addition, all combinations of the 4 of them are alsodeemed to have a controlling interest in the business of the trust.

Indirect relationships [ss.72(3), (4), (5), (7) & (8)]

(a) Related corporations [s.72(3)]

Where corporations are related under s50 of the Corporations Act 2001 (Cth), any one of those corporations is deemed to have a controlling interest in any business in which a related corporation has a controlling interest (s.72(3)).

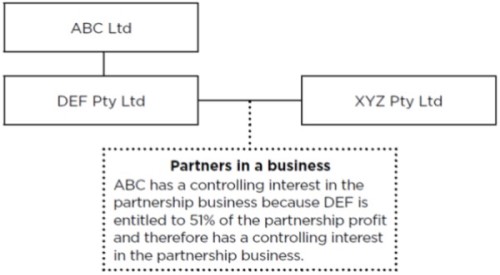

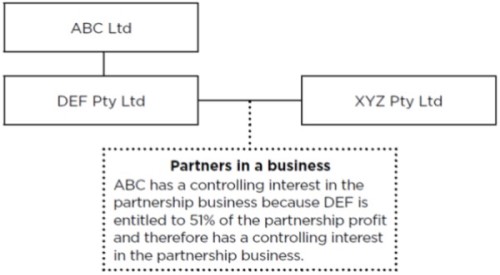

ABC Ltd owns 100% of the shares in DEF P/L. Therefore, ABC Ltd and DEF P/L are related corporations and constitute a group under section 70.

DEF P/L and XYZ P/L are partners in a partnership. DEF P/L is entitled to 51% of the income of the partnership. and therefore has a controlling interest in the partnership business under section 72(2)(f).

Therefore, ABC Ltd also has a controlling interest in the partnership business under section 72(3).

(b) Indirect controlling interest in a business [s.72(4)]

Where a person has a controlling interest in one business and the person who carries on that business has a controlling interest in another business, then the first person is deemed to have a controlling interest in that other business. This provision also applies if a set of persons has the controlling interest.

John Smith has a controlling interest in Business A. The person who conducts Business A has a controlling interest in Business B. John Smith therefore also has a controlling interest in Business B.

(Note that the entities that conduct Business A and Business B may be individuals, companies or trustees)

(c) Indirect controlling interest in a trust business [s.72(5)]

Where a beneficiary of a trust (or 2 or more beneficiaries together) has or have a controlling interest in the business of a trust, and the trustee either alone or as a joint trustee has a controlling interest in a second trust business, the beneficiary (or beneficiaries together) has (or have) a controlling interest in the second trust business (s.72(5)). This provision doesn’t apply where the trustees act for different trusts.

ABC Pty Ltd atf the Kim Family Trust carries on business C. Mary Kim is a beneficiary of the trust and therefore has a controlling interest in Business C.

ABC Pty Ltd and Paul Jones as joint trustees of the Jones Family Trust have a controlling interest in business D conducted on behalf of the Jones Unit Trust.

Mary Kim therefore also has a controlling interest in Business D.

Therefore, the trustees of Business C and Business D are grouped.

(d) Indirect controlling interest in a corporation’s business [s.72(7)]

Where a person (or 2 or more persons together) has or have a controlling interest in a business carried on under a trust, and the trustee either alone or as a joint trustee has a controlling interest in a business conducted on behalf of a corporation, then that first person (or persons together) also has (or have) a controlling interest in the business of the corporation. This provision doesn’t apply where there are multiple trustees but they each act for a different trust.

Geoff Young is a beneficiary of the Geoff Young Family Trust and therefore has a controlling interest in Business E conducted by the trustee of the Geoff Young Family Trust.

The trustee of the Geoff Young Family Trust has a controlling interest in Business F conducted by F Pty Ltd.

Therefore, Geoff Young also has a controlling interest in Business F, and the trustee of the Geoff Young Family Trust and F Pty Ltd are grouped.

(e) Indirect controlling interest in a partnership business [s.72(8)]

Where a person (or 2 or more persons together) has (or have) a controlling interest in a business carried on under a trust, and the trustee either alone or together with a joint trustee has a controlling interest in a business conducted by a partnership, then that first person (or persons) also has (or have) a controlling interest in the business of that partnership (s.72(8)). This provision doesn’t apply where each of the trustees act for a different trust.

Bill Williams as a beneficiary of the Williams Family Trust has a controlling interest in Business G conducted by the trustee on behalf of the trust.

The trustee of the Williams family Trust has a controlling interest in Business H conducted by a partnership because it is entitled to 51% of the profits of the partnership.

Therefore, Bill Williams also has a controlling interest in the partnership’s Business H, and the trustee of the Williams Family Trust and the Partnership are grouped.

Tracing of interests in corporations – s.73

Under the tracing provisions, an “entity” is grouped with a corporation if the person or persons who are members of an entity together have a controlling interest in a company.

An “entity” is defined in s.73, and includes specified relatives, companies, trusts and beneficiaries of trusts.

An entity has a controlling interest in a company if the entity has:

- a “direct interest” in the share capital of the company of more than 50 per cent, or

- an “indirect interest” in the share capital of the company of more than 50 per cent or

- an “aggregate” interest in the share capital of the company, of more than 50 per cent.

A “direct interest” in a company exists where the entity can directly or indirectly exercise, control or influence the voting power attached to the voting shares in the company. The value of the direct interest is the proportion of the company’s voting shares, expressed as a percentage, that the entity can exercise, control or influence.

An “indirect interest” exists where the entity has a direct interest in a company (directly controlled company), which is linked to another corporation. A company is linked to a directly controlled company if it is part of a chain of companies where each link in the chain has a direct interest in the next company in the chain.

An “aggregate interest” is the sum of an entity’s direct and indirect interests.

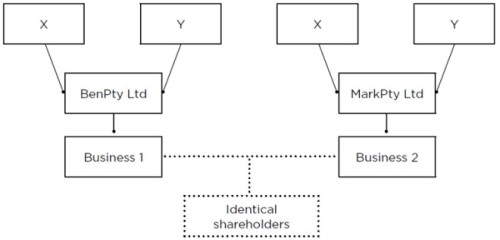

Mr and Mrs Chan conduct a family business. They are associated persons for the purposes of s.73 because they are husband and wife and therefore they are an “entity”.

Mr and Mrs Chan jointly own 80% of the voting shares in Company A, 20% of the voting shares in Company B and 30% of the voting shares in Company C.

Company A owns 70% of the voting shares in Company B.

Company B owns 50% of the voting shares in Company C.

Mr and Mrs Chan own 80% of the voting shares in Company A and have a controlling interest in the company.

Mr and Mrs Chan have an “aggregate interest” in Company B of 76%, and therefore a controlling interest, consisting of a “direct interest” of 20%, and an “indirect interest” of 56% (80% x 70%).

Mr and Mrs Chan have an “aggregate interest” in Company C of 58%, and therefore a controlling interest, consisting of a “direct interest” of 30% plus an “indirect interest" of 28% (80% x 70% x 50%).

Mr & Mrs Chan are therefore grouped with all 3 Companies.

Subsumed groups – amalgamations of smaller groups

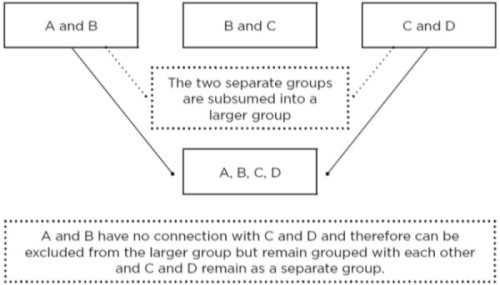

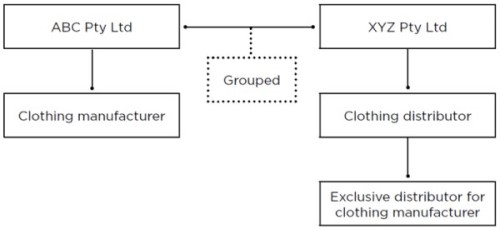

Where two or more groups have at least one member which is common to each, those groups are subsumed or amalgamated into a larger group by s.74(1) of the Act.

In addition, if 2 or more members of a group together have a controlling interest in another business under any of the grouping provisions, all of the members of the larger group are grouped with the entity that carries on that other business.

Interstate employers

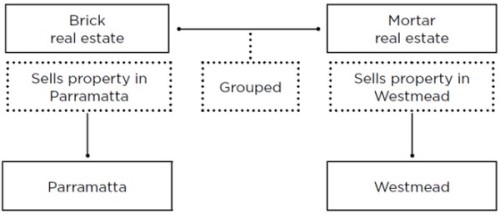

The grouping provisions apply to businesses regardless of where they operate. Accordingly, two businesses may be grouped even though one is located in NSW and the other in another state or territory, or in another country.

This is important for the purposes of determining a group’s total Australian wages because it will have an impact on the threshold that the group is entitled to claim in NSW (and in other states and territories). Where members of a group have interstate wages, the group’s threshold will be reduced, using the proportion of total Australian wages that consist of NSW wages. For example if total NSW wages represent 50% of total Australian wages, the NSW threshold is reduced to 50% of the full monthly and annual thresholds.

Exclusion from a group

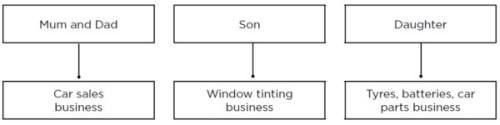

The grouping provisions were introduced to counter tax avoidance practices through the splitting of business activities by creating additional entities to conduct parts of a single business, or discrete but related business activities. Each entity was able to claim the threshold. The provisions are very broad in their application, and consequently may result in entities being grouped even though there may be no substantial connections between the persons who own or control the businesses, and no substantial business or operational connections.

In order to avoid unfair or unintended grouping outcomes, the Chief Commissioner has a discretion to exclude a member from a group in cases where the business of one group member is carried on “substantially” independently of, and is not “substantially” connected with the carrying on of the businesses of other members of the group. However, a purpose or intent to avoid payroll tax is not specified as a relevant factor in the Act. The absence of such a purpose or intent may be taken into account, but the absence of such a purpose does not mean the Chief Commissioner must or should exercise the discretion.

Where a single member of a group applies for an exclusion order, the tests for exclusion must be satisfied in respect of the relationship between the member (or members) seeking exclusion and every other member of the larger group.

Where a group is made up of smaller groups that have been subsumed into a larger group under s.74, the members of a smaller group may be excluded from the larger group. The businesses carried on by all members of the smaller group must be substantially independent of, and not substantially connected with the businesses carried on by every other member of the larger group. It doesn’t matter if the members of the smaller group are not entitled to be excluded from their smaller group. The excluded members of the smaller group become a separate group.

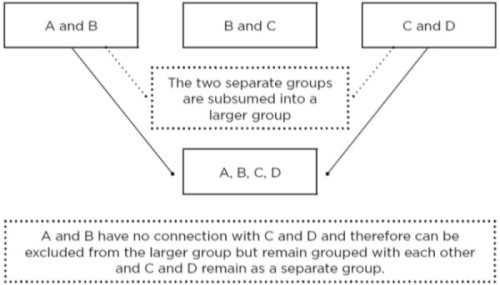

A & B form one group, B & C form a second group and C & D form a third group. The 3 separate groups are subsumed into a single, larger group under s.74. The larger group consists of A, B, C & D.

A and B have substantial connections and are not entitled to be excluded from being grouped with each other. However, A and B are both substantially independent of, and do not have substantial connections with either C or D. Therefore, A & B are entitled to be excluded from the larger group, but remain grouped with each other. C & D remain as a separate group.

However, where an application is made to exclude only a single member of a group, that member cannot be excluded unless its business is substantially independent of, and not substantially connected with the businesses carried on by every other member.

In the above example, A cannot be excluded from the larger group unless B is also excluded.

Who may apply for exclusion?

This discretion is available to members of a group if the group arises as a consequence of the following provisions:

- use of common employees (s.71),

- “controlling interests” in 2 businesses (s72),

- tracing of interests in corporations (s.73).

Who cannot apply for exclusion?

The discretion is not available for members that are grouped because they are related corporations within the meaning of s.50 of the Corporations Act 2001 (Cth) 9 (see s.79(3) of the Payroll Tax Act).

What factors are considered?

The Commissioner may exclude an eligible member from a group if satisfied the business conducted by that member:

- is carried on substantially independently of, and

- is not substantially connected with the carrying on of each of the businesses carried on by every other member of the group (s.79).

In deciding whether to exclude an employer from a group, the Chief Commissioner must have regard to the nature and degree of ownership and control of the businesses, the nature of the businesses and any other matters the Chief Commissioner considers relevant. However, the Chief Commissioner cannot base a decision of whether or not to grant an exclusion order, those ownership and control factors that resulted in the grouping:

(a) the nature and degree of ownership and control of the businesses,

eg: the extent of the common ownership or control which resulted in each member being part of the group.

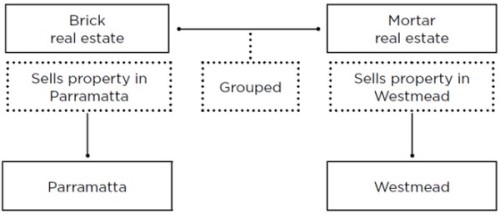

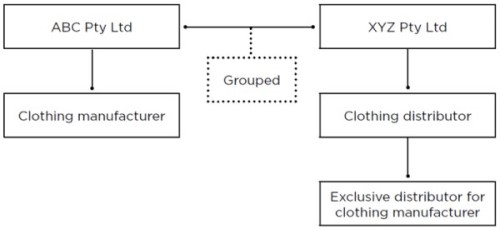

(b) the nature of the businesses, such as:

- whether group members operate in the same or related industries;

- whether there is any vertical or horizontal integration of the grouped businesses;

Note:

- Vertical integration of businesses describes a chain of businesses in related industries where the output of one business becomes the input for another business in the chain eg an iron ore mine produces ore which becomes the input for a steel smelting business.

- Horizontal integration describes businesses in the same industry whose products are differentiated in some way eg clothing stores that sell different types of clothing, such as women’s’ clothing, men’s’ clothing, or work clothes.

- Any other matters that are relevant in determining whether the businesses are operating independently or have business connections eg family connections, non-commercial arrangements.

Independence and connections of grouped businesses

In deciding whether a business is carried on substantially independently, the connections between the persons who can control or influence management decisions are considered (see John French Pty Ltd v Commissioner of Pay-roll Tax (Qld) [1984] 1 Qd R 125).

An exclusion order may be made if, taken as a whole, both the inter-dependencies and the connections are not substantial.

1. Independence in management and control

- Ability of the senior management of a group member to control or influence management or business decisions of another group member, even if control or influence is not or is rarely exercised (Cessnock Tyres Pty Ltd v CCSR [2017] NSWCATAD 368 at [64]); control or influence by owners, or directors of a company, is more significant than senior executives who manage day to day business operations.

- Common control of day-to-day operations by the same operational managers is less significant than control or ability to control by a principal, or by directors in the case of a company. If 2 businesses are controlled by different principals or directors, having common operational control by an Operations Manager is less significant because principals and directors are generally able to exercise control or influence Operations Managers.

- In the case of a group whose members have family connections, the ability of particular members of the family to influence the management or activities of group members, and collective decision-making by family members, are significant factors (see Lombard Farms Pty Ltd v Chief Commissioner of State Revenue [2013] NSWADT 17 at [44].

2. Operational connections

Connections between businesses in their day-to-day operations are relevant in deciding whether to exclude a business from a group. Individual connections may be insignificant, but increase in importance as the number and business-significance of the connections increase.

Relevant operational connections include:

- financial connections between group members such as intra-group loans, particularly where the loans are not evidenced by formal documentation or are not based on arms-length terms and conditions (see Lombard Farms Pty Ltd v CCSR [2014] NSWCATAD 132 at [50]) relevant factors include:

- the relative size of the loan compared to the capital employed in the business;

- the relative importance of the loan to the borrower and/or the lender;

- whether the terms of the loan are evidenced in writing;

- whether the terms of the loan including interest rate and repayment provisions are based on commercial terms applying generally to loans between unrelated parties;

- whether the terms of the loan are enforced in accordance with principles that usually apply to loans between unrelated parties.

- trading arrangements between group members may indicate the businesses may operate in a similar way to a single, integrated business (see Cessnock Tyres Pty Ltd v Chief Commissioner of state Revenue [2017] NSWCATAD 368 at [57 -58]; Headwear Pty Ltd v Chief Commissioner of State Revenue [2015] NSWCATAD 166) at [105]). Some examples include:

- members jointly enter into purchasing or sales transactions with common suppliers, or obtain volume discounts for purchases by combining their purchases;

- non-commercial terms applying to intra-group purchases and sales;

- group members make intra-group stock transfers to minimise group stock levels, and to minimise stock shortages by group members;

- marketing or advertising arrangements between group members, such as use of a common website;

- the use of shared staff, business premises or facilities and other resources is relevant to deciding whether the connections between group members are substantial (see Eastside Veterinary Emergency & Specialists Pty Ltd v CCSR [2016] NSWCATAD 104 at [20] & [75]); individual connections may be unimportant, but take on greater significance as the number of such connection increase; relevant operational connections include:

- use of the same registered office;

- use of the same accounting firm;

- use of the same telephone numbers;

- use of the same employees or contractors for particular functions, such as telephone inquiries and maintenance of website content;

- use of common or adjacent business premises;

- use of the same bank accounts.

- Extent to which group members provide related or integrated services to the same customers or customers in the same industry, including:

- connections between businesses providing different services or products in the same industry; eg referral of customers from a generalist veterinarian practice to an animal hospital (Eastside Veterinarian Emergency & Specialists Pty Ltd v CCSR [2016] NSWCATAD 104);

- connections between businesses providing the same or similar services to different segments of customers.

Case summaries

Appendix A contains brief outlines of the key facts and circumstances that were found to be significant in recent Court and Tribunal decisions in which the Chief Commissioner’s decisions not to order an exclusion were reviewed.

Appendix A: Exclusion Applications

Key Facts in Recent Court & Tribunal Decision

Cessnock Tyres Pty Ltd v CCSR [2017] NSWCATAD 368

There were 4 entities in the group, with 3 separate retail tyre businesses, and each business outlet was conducted by 1 of 3 sons of the founder of the businesses.

Each of the entities was in the business of tyre retail sales, primarily for different types of vehicles, and each was controlled by a separate trust. The 3 businesses traded as “O’Neil’s Tyres”.

The Tribunal determined that the Chief Commissioner’s refusal to degroup the Applicant was correct and the decision was confirmed. The key facts and circumstances relied upon by the Tribunal were:

- the entities conducted similar businesses under a common name and marketing arrangements and a common website, influencing public recognition of the entities as one large, interrelated group;

- the entities obtained group discounts and rebates when purchasing stock;

- the size of the intra-group loans was considered a substantial connecting factor particularly given the absence of formal documentation;

- the authority and potential of 1 of the brothers to control the business.

Factors that the Tribunal considered were not significant included:

- the intra-group sourcing of products when one store was out of stock;

- the use of a common accountant was not considered important.

Read the full case summary: Cessnock Tyres Pty Ltd v CCSR [2017] NSWCATAD 368.

Eastside Veterinarian Emergency & Specialists Pty Ltd v CCSR [2016] NSWCATAD 104

The Chief Commissioner grouped an entity that conducted a veterinary clinic with another entity that conducted a veterinary hospital because 2 Doctors held controlling interest in both businesses.

The Tribunal affirmed the Chief Commissioner’s decision not to order an exclusion because the two businesses were closely associated with and complimentary to each other, having regard to the following factors, when considered cumulatively and objectively:

- the businesses were conducted on neighbouring properties;

- they shared the same premises as their registered offices and principal places of business according to information provided by them to ASIC;

- one of the doctors had been a guarantor of the obligations of both entities;

- at various times up to six people recorded on the payroll of both entities;

- the two entities were joint lessees of X-ray and blood equipment which they shared, and split the cost of the equipment between them;

- the website for the hospital had a link to the website for the clinic;

- both websites advertised the services of the 2 doctors who held the controlling interests;

- both businesses recorded the same telephone number, postal and business addresses in income tax and BAS records;

- the businesses used the same tax agents for income tax purposes in 2014;

- the clinic charged fees to the hospital in 2014;

- the businesses have common suppliers of medication;

- the 2 doctors who held the controlling interests were both cheque signatories for the 2 businesses;

- one of the doctors lodged a notice with ASIC that he ceased to be a director of the clinic 2 days after the clinic lodged its exclusion application.

Read the full case summary: Eastside Veterinarian Emergency & Specialists Pty Ltd v CCSR [2016] NSWCATAD 104.

Headwear Pty Ltd v Chief Commissioner of State Revenue [2015] NSWCATAD 166

Four entities were grouped by the Chief Commissioner in 2012. Each entity conducted a business in the headwear industry, and each one operating mainly in 1 of 4 different Australian states (NSW, Queensland, Victoria and WA). Advisers to the 4 businesses conceded that the 4 businesses were correctly grouped.

The 4 members of the group had been in the headwear manufacturing and sales industry since 1974, with a distribution network serving all continents of the world. The group specialised in providing customised headwear for corporate, sporting, licensed and retail customers. The NSW trustee (“the Applicant”) sought exclusion from the group. The Applicant mainly carried on business in NSW.

The Tribunal decided that the applicant had not discharged its onus of satisfying the Tribunal on the balance of probability that for any tax year during the relevant period the business of the Applicant was carried on independently of and was not connected with the carrying on of each of the other group business.

The main factors taken into account by the Tribunal were:

- the role played by an individual (who together with another individual had a controlling interest in the NSW business) in the business activities of both the NSW business and the WA business:

- the supply of all stock to all group members from a single factory in China;

- exclusive communications between the 4 businesses and the factory through the WA business;

- the key role of 2 people who together had a controlling interest in the NSW business; in communications with that factory;

- the financial connections between the Applicant and the Barblett Trust, which was described as the major equity owner in each of the NSW, Queensland and Victorian businesses;

- the fact that the NSW business did not consider alternate sources of stock, funding and providers of administrative and accounting services;

- group marketing through a single Headwear Group website;

- the communication process for potential clients of the Headwear Group; and

- the use of the same “Headwear” branding by all group members.

Read the full case summary: Headwear Pty Ltd v Chief Commissioner of State Revenue [2015] NSWCATAD 166.

Lombard Farms Pty Ltd v CCSR [2014] NSWCATAD 132

Lombard Farms sought a review of a decision by the Chief Commissioner not to exclude it from a grouped with 4 other companies. The shareholders and directors of the companies were all members of the same family, but Lombard Farms conducted businesses in the agricultural sector, whereas the other group members operated mainly in the building industry.

The Tribunal upheld the Chief Commissioner’s decision not to exclude Lombard Farms from the group. The Tribunal accepted that the family member who conducted the business of Lombard Farms was the sole decision maker for the business. However, the Tribunal upheld the decision of the Chief Commissioner because:

- the ultimate ownership and control of Lombard Farms was capable of being exercised by family members; and

- a substantial intercompany loan to Lombard Farms was made on non-commercial terms, and was not enforced when a default occurred, avoiding liquidation.

The Tribunal determined that these 2 factors alone were sufficient to confirm the Chief Commissioner’s decision, but also identified the following as significant connections: - property leases between Lombard Farms and other group members;

- another group member conducted administrative, treasury and banking services for Lombard Farms as well as other group members;

- there were no formal meetings of directors of the companies in the group, including Lombard Farms; instead, there were family meetings once or twice a year, but no minutes of the meetings were kept.

Read the full case summary: Lombard Farms Pty Ltd v CCSR [2014] NSWCATAD 132.

Regis Mutual Management Pty Ltd v Chief Commissioner of State Revenue 2015 NSWCATAD 213

Regis Mutual Management (RMM) was established as a special purpose vehicle for a joint venture between Regis Mutual Management Ltd (“Regis”) and Capricorn Society Ltd (CSL). Services were performed by CSL employees for or in connection with RMM’s business. Therefore, CSL and RMM were grouped under s.71(3) (use of common employees). RMM sought exclusion from bring grouped with Regis and CSL.

(a) Ownership and control of RMM by CSL

CSL through its subsidiary Capricorn Society Financial Services Pty Ltd (CSFS) owned 50% of the issued capital of RMM, and was entitled to exercise 50% of the votes at meetings of members of RMM.

The board of directors of RMM consisted of 3 directors appointed by Regis and 2 appointed by CSL, but only 2 appointees of each company were voting directors. Therefore, neither the Regis directors nor the CSL directors could control decisions of the RMM Board, but the Tribunal considered it was significant that CSL had a right to veto decisions of the Board.

(b) Significance of the nature of the businesses

The principal activity of the Group was the operation of an automotive parts and accessories buying company operating along cooperative principles. Other entities provide travel, risk protection management, financial services and technology services.

CSL and RMM were actively competing for business, but the Tribunal found this lessened the strength of RMM’s submissions that the nature of the two businesses were fundamentally different.

However, having regard to Toveety Maintenance Services Pty Ltd v Chief Commissioner of State Revenue [2015] NSWCATAD 137, the Tribunal considered that the nature of relevant businesses may not be all that critical to a degrouping decision.

(c) Substantial Independence and no substantial connection

The Tribunal was not satisfied RMM’s business was carried on substantially independently or that there were no substantial connections with CSL’s business because;

- the Services provided by CSL to RMM throughout the relevant period were important to RMM’s existing and proposed business activities;

- significant fees were paid by RMM to CSL, without any evidence of RMM considering alternative sources;

- services were provided by CSL to RMM for a considerable length of time before a service agreement was documented;

- group workers’ compensation insurance was taken out for much of the relevant period;

- CSL provided financial guarantees for the benefit of RMM without consideration and without evidence of an indemnity or other protection being offered or provided by RMM;

- Start-up capital of $300,000 was provided by CSL to RMM, and while that amount was relatively insignificant to CSL, it was the bulk of RMM’s start-up capital and was important to RMM’s ability to remain solvent.

Read the full case summary: Regis Mutual Management Pty Ltd v Chief Commissioner of State Revenue 2015 NSWCATAD 213.

Seovic Engineering Pty Ltd v Chief Commissioner of State Revenue [2015] NSWCA 2

At first instance, in an appeal to the ADT, 3 companies (“Civil”, “Engineering” and “Excell”) were successful in arguing that the Chief Commissioner had erred in not exercising the discretion under s 79 of the Payroll Tax Act to grant an exclusion order. The Chief Commissioner’s appeal to the Appeal Panel was allowed. The 3 companies sought leave to appeal against the decision of the Appeal Panel.

The question before the Appeal Panel was whether the agreed facts, and facts as found by the Tribunal, were capable of satisfying the precondition for the grant of an exclusion order in s 79(2). The Appeal Panel decided the undisputed facts and facts as found by the Tribunal were not capable of satisfying this precondition. The Appeal Panel allowed the appeal, set aside the Tribunal’s orders and dismissed the application.

The Appeal to the Court of Appeal raised 3 questions of law. The 3 questions and the findings of the Court of Appeal were:

- Whether the Appeal Panel should have determined that s. 79 confers a broad discretion enlivened whenever the exclusion of persons from a group is just and reasonable, in order to alleviate otherwise harsh consequences of the grouping provisions.

The Court of Appeal rejected this characterisation of the test. The Court decided that the Chief Commissioner must be satisfied that the business carried on by a person is carried on independently of, and is not connected with the carrying on of, a business carried on by any other member of the group. This is the statutory test.

- Whether the Appeal Panel was obliged to take into account the following matters as mandatory “relevant considerations”:

Whether there was the presence or absence of artificial or contrived arrangements to avoid payroll tax; and

Whether there was splitting of existing businesses and other stratagems; and

Whether there were commercial arm’s-length terms of dealings between group members.

The Court of Appeal decided that only (c), (the ‘commercial arm’s-length terms of the dealings between group members’), was a mandatory “relevant consideration”. The Court decided that the Appeal Panel had taken this consideration into account. The Court held that the other two matters did not concern the mandatory considerations ie “the nature and degree of ownership and control of the businesses” or “the nature of the businesses” specified in s.79(2) and therefore were not mandatory relevant considerations.

- Whether the Appeal Panel erred in failing to consider the “nature and degree of ownership and control of the businesses” of the businesses as a mandatory “relevant consideration” (s. 79(2)).

The Court of Appeal concluded that the Appeal Panel took into account the “nature and degree of ownership and control” of Civil and Engineering. The Appeal Panel had concluded that “Civil” and “Engineering” each carried on their businesses independently and without any connection with each other” and there was “no evidence of control in the management of Excell”. However, Excell provided day to day management and administrative staff to Civil and Engineering, who were Excell’s only customers, and the carrying on of the businesses of each of Civil and Engineering was connected to Excell's carrying on of its business. Accordingly, The Court of Appeal confirmed that a statutory precondition to exclude a member from a group, namely the absence of a substantial connection with every other member of the group, was not met.

Read the full case summary: Seovic Engineering Pty Ltd v Chief Commissioner of State Revenue [2015] NSWCA 2.