CPN 034: Determining arms length transactions and pricing

|

Practice Note number

| CPN 034 |

|

Tax/benefit |

Mineral Royalties |

|

Date issued

| 22 August 2025 |

|

Issued by

|

Cullen Smythe

Commissioner of State Revenue

|

| Effective from | 1 July 2025 |

| Effective to | - |

|

Status

|

Current |

Purpose

The purpose of this Commissioner’s Practice Note is to provide guidance to Holders of Mineral leases (“Holders”) on the Commissioners interpretation of the meaning of “arm’s length” and how these principles apply to valuing coal in NSW.

Background

This CPN should be read in conjunction with the Mining Act 1992 (“the Mining Act”), the Mining Regulation 2016 (“the Regulation”), and the Value of Coal Recovered Ministerial Determination (“the Determination”). It should also be referenced alongside the following Commissioner practice notes: CPN 032, which outlines what mineral royalties are, and CPN 033, which covers coal blending, beneficiation deductions, foreign exchange rate changes and provisional sales.

Coal royalty is payable on an ad valorem basis, where royalty is calculated as a percentage of the value of the coal that is disposed of during a royalty period. The ad valorem rates are specified in section 74 of the Regulation. These rates vary depending on the type of mining operations i.e. open cut, underground, or deep underground.

The Regulation provide that the quantity of coal taken to have been recovered during a royalty period is the quantity of coal disposed of by the Holder during the royalty period. The Determination prescribes the way the value of coal recovered by a Holder is to be calculated.

Export coal and domestic coal are treated differently.

Unless otherwise noted, words have the same meaning as in the Mining Act, the Regulation and the Determination.

ABC Pty Ltd is a holder of a coal mining lease. During a royalty period, they extracted 90,000 tonnes of coal from their lease. However, they disposed 80,000 tonnes of that coal in April, with the remaining 10,000 tonnes being stockpiled.

The quantity of coal "taken to have been recovered" for April would be the 80,000 tonnes that ABC Pty Ltd disposed of.

Even though they extracted 90,000 tonnes, only the quantity they disposed of is considered recovered for the purpose of calculating royalties.

This means the royalties are based on the coal sold (or otherwise disposed of) not necessarily the amount physically extracted.

Commissioner’s Practice Note

What is export coal?

As per the Determination, export coal is coal that is:

- exported to a destination outside of Australia for consumption;

- sold free-on-board (FOB).

Free on board is taken to mean that the supplier retains ownership and responsibility for the goods until they are loaded ‘on board’ a shipping vessel. Once on the ship, all liability transfers to the buyer.

How export value is determined:

The Determination provides that the export value of coal is:

… the total amount received or recoverable in respect of export coal disposed of in an arm’s length transaction during the royalty period. Where the free-on-board rate is not being used i.e. where the export coal is disposed of on a Cost Insurance Freight (CIF) basis, the cost of ocean freight and insurance is to be subtracted to arrive at an equivalent free-on-board price. Any other costs, including but not limited to, costs associated with transporting the coal to the point of loading, insuring the coal before that point, preparing the coal for loading or loading the coal on to a vessel are not deductible.

What is domestic Coal?

As per the Determination, domestic coal is defined as coal consumed or to be consumed within Australia.

How is domestic value determined:

The Determination provides that the domestic value of coal is:

… the total amount received or recoverable in respect of domestic coal disposed of in an arm’s length transaction during the Royalty Period.

What are arm’s length transactions?

The term “arm’s length” denotes a transaction wherein both parties act in their own self-interest, where neither party has an undue influence over the other party, and no preferential treatment is given. These transactions are unaffected by any special relationship or arrangements between the parties, and non-commercial considerations do not impact the fairness of the market price paid for the product1.

Key characteristics of an arm's length transaction include:

- Independence of Parties: Both parties must act independently and without influence or control over each other2.

- Fair Market Value: The price agreed upon should reflect fair market value, i.e. what would be charged between unrelated parties in an open market3.

- Equal Bargaining Power: The parties should have equal access to relevant information and no undue influence on each other’s decision-making4.

- Commercial Reasonableness: The transaction must make business sense and follow standard market practices5.

- No Conflict of Interest: An arm’s length transaction should be free from conflicts of interest, meaning no hidden relationships or ulterior motives should distort the fairness of the transaction6.

Where coal is disposed of in an arm’s length transaction, the price charged should be the price returned by the Holder in the royalty return for the period. This is the case even if the price charged is higher or lower than the fair market value of the coal. This is because there may be other circumstances surrounding the transaction which affect the price charged.

The fair market value reflects the price the coal would typically fetch in an open market, while the arm’s length value may differ due to factors such as the circumstances surrounding the transaction.

What are related party transactions?

The term “related party transaction” is defined in the Determination:

A related party transaction is taken to occur when the Holder disposes of coal to a relevant entity.

The Determination defines:

Disposal as deeming to occur when legal title is transferred from the Holder to another entity.

Relevant Entity as:

- for a company - an “associated entity” of the company (within the meaning of s.50AAA Corporations Act 2001 (Cwlth)), a related entity of the company (within the meaning of s.9 of the Corporations Act) or a related party of the company (within the meaning of s.228 of the Corporations Act)

- for an individual - a “related person” of the individual within the meaning of “associated person” as defined in clause 2, Dictionary, Duties Act 1997 (NSW).

Can related party transactions be at arm's length?

Related party transactions may be considered arm's length if they satisfy the criteria of independence despite the existing relationship between the parties. However, in the absence of evidence to the contrary, such transactions are generally presumed not to be at arm's length. It is the responsibility of the involved parties to prove that the transaction complies with arm's length principles7.

The Holder must collect and maintain evidence to support:

- Fair Market Value: The price agreed upon should reflect fair market value, i.e. what would be charged between unrelated parties in an open market8.

- Equal Bargaining Power: The parties should have equal access to relevant information and no undue influence on each other’s decision-making9.

- Commercial Reasonableness: The transaction must make business sense and follow standard market practices10.

- No Conflict of Interest: An arm’s length transaction should be free from conflicts of interest, meaning no hidden relationships or ulterior motives should distort the fairness of the transaction11.

Where coal is disposed of in an arm’s length transaction, the price charged should be the price returned by the Holder in the royalty return for the period. This is the case even if the price charged is higher or lower than the fair market value of the coal.

Differences between the arm’s length price and the fair market value can arise due to various factors related to the transaction.

Notification and reporting documentation for related party transactions

The Determination mandates that leaseholders notify an Authorised Officer of any related party transactions occurring during a royalty period. This notification must be made by the 21st day of the month following the period in which the transaction occurred. Information on the reporting, notification and suppling the required information can be found at Coal royalties return lodgement.

How to determine the arm’s length price?

An arm’s length price is the price that would reasonably be expected to have been obtained in an arm’s length transaction.

Determining an arm’s length price can assist in determining:

- whether a sale price was fair market value, which may weigh in favour of the transaction being an arm’s length transaction; and/or

- where the transaction is not an arm’s length transaction, the arm’s length price that should be returned by the Holder instead of the sale price.

Determining the arm’s length price can be based on one or more of the following methods:

- the open market value for the coal at the relevant time point or

- Comparable Uncontrolled Price (CUP) method; or

- the Holder may set and substantiate an amount as their value, known as the "alternative value". Typically, if the Holder fails to establish this value, the open market value will be applied.

Open Market Value

The open market value of coal can be determined by referring to:

- A listed price or an average listed price from a reputable recognised coal trading platforms or indexes, such as:

- for thermal coal globalCOAL - NEWC Index - Global Coal Newcastle Coal Price Index (“gCNEWC Index”) or the Argus and McCloskey's API5 Index (“Argus API5”), and

- for metallurgical coals (i.e. hard coking coal, semi-hard coking coal, semi-soft coking coal, and Pulverised Coal Injection (“PCI”) coal) the S&P Global Platts Index (“Platts Index”).

* Average listed price means - a price worked out by averaging the prices listed for a mineral in a recognised listing over a period of three months or less during which time the mineral is disposed.

* Listed price means - a price listed in a recognised listing at the time the mineral is disposed.

- A sale price in an arm’s length transaction, where a similar sale has occurred within the last 2 years.

If coal is sold in an arm's length transaction to a buyer (not being a Relevant Entity of the Holder), and the Holder has previously sold similar quality coal in such a transaction within the last two years to another non-relevant entity, then the price rate obtained would ordinarily meet the requirement of being reasonably expected to have been obtained because the coal was sold to an arm’s length buyer.

Additionally, this price may be checked against current market values to ensure that it reflects fair market conditions at the time of the sale. - A sale price in an arm’s length transaction agreed to before or soon after the coal’s extraction.

If the Holder has entered into an agreement, either before or promptly after the coal’s extraction, to sell the coal in an arm's length transaction to an entity other than a Relevant Entity, the market value is determined based on that agreement.

Should the Chief Commissioner of State Revenue (“Chief Commissioner”) not be satisfied that an arm’s length price has been returned using the above practice a price substitution may be made by the Chief Commissioner. Additional interest or penalty charges may also apply on any resulting assessments.

ABC Pty Ltd, a coal mining leaseholder, entered into a sales agreement in March 2024, right before extracting 50,000 tonnes of coal. The agreement was with a third-party buyer, SteelWorks Ltd, which is not related to ABC Pty Ltd. Since this sale was conducted at arm’s length, the price agreed upon in the contract is considered to represent the market value of the coal.

However, if the Chief Commissioner reviews the transaction and determines that the price does not reflect an arm’s length value (e.g. if the agreed price was significantly lower than current market prices for similar quality coal), the Chief Commissioner may substitute a higher market price. This adjustment could incur additional interest or penalty charges on the revised assessments.

Comparable Uncontrolled Price (CUP) method

To determine an arm’s length price using the CUP method, a Holder must identify comparable transactions it has conducted with unrelated third parties. To comply with the CUP principles, the terms of transactions with related parties must align with those of the third-party transactions. The goal is to identify comparable arm’s length transactions and to determine an equivalent arm’s length price.

This method involves the following steps:

- Identify comparable transactions: The first step is to gather (and retain) information on transactions between unrelated parties for similar circumstances. These transactions should be as similar as possible to the related party transaction under consideration.

- Analyse comparability factors: Key factors need to be considered (and maintained) to ensure comparability between the identified transactions and the related party transaction. Factors may include quality, quantity, geographical location, terms and conditions of any agreements, and any other relevant factors that may affect the price.

- Determine the price: Once comparable transactions have been identified and analysed, an appropriate price can be determined. This is done by examining the comparable transactions and adjusting for any differences or variations in the comparability factors.

- Apply the price: Finally, the determined value is to be applied to the return with records to be held.

Alternate method for establishing an arm’s length price

A Holder may provide an alternative arm’s length price. An alternate pricing method may be used where the open market value and CUP is not appropriate or not available.

It is important to note that the responsibility rests with the Holder to demonstrate and validate that the alternative price would reasonably be expected to have been obtained if the coal had been sold in an arm's length transaction.

To support a value using another approach, additional documentation should be retained (and provided upon request by the Chief Commissioner). This could include the following:

- An independent expert valuation report that assesses the reasonableness of the pricing arrangement. The report should also include a valuation of the saleable mineral commodity for the relevant period, along with the terms of reference or letter of engagement for the report.

- Sales contracts and invoices between the Holder and Relevant Entities, as well as between the Relevant Entities and non relevant entities.

- Sales and marketing agreements, agency agreements, and umbrella agreements between the Holder and Relevant Entities, as well as between the Relevant Entities and non relevant entities.

- Various financial documents of all the Relevant Entities that are subject to the aforementioned agreements.

- Information to substantiate that the sales to Relevant Entities are conducted at arm's length.

- Documentation establishing the structure and nature of the Holder and its Relevant Entities.

- A detailed description of the arrangements, transactions undertaken by different parties that ultimately lead to the saleable mineral commodity being sold to an unrelated party. This should also include the identification of all parties involved.

- Financial statements and reports of the Holder and any Relevant Entities involved in selling the coal.

- Comparable sales.

- Any other relevant information.

If the Chief Commissioner is not satisfied that the alternate value fairly reflects an arm’s length price the Chief Commissioner may issue an assessment with a substituted value. This value may include, but is not limited to, using the first arm’s length sales price or using the CUP for determining the appropriate value.

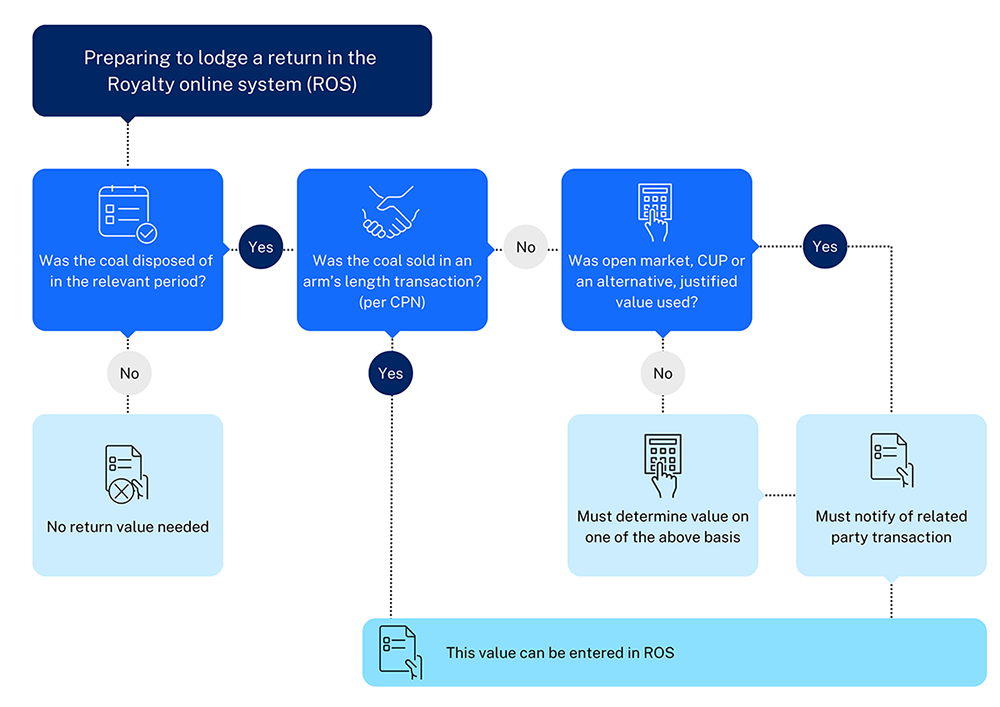

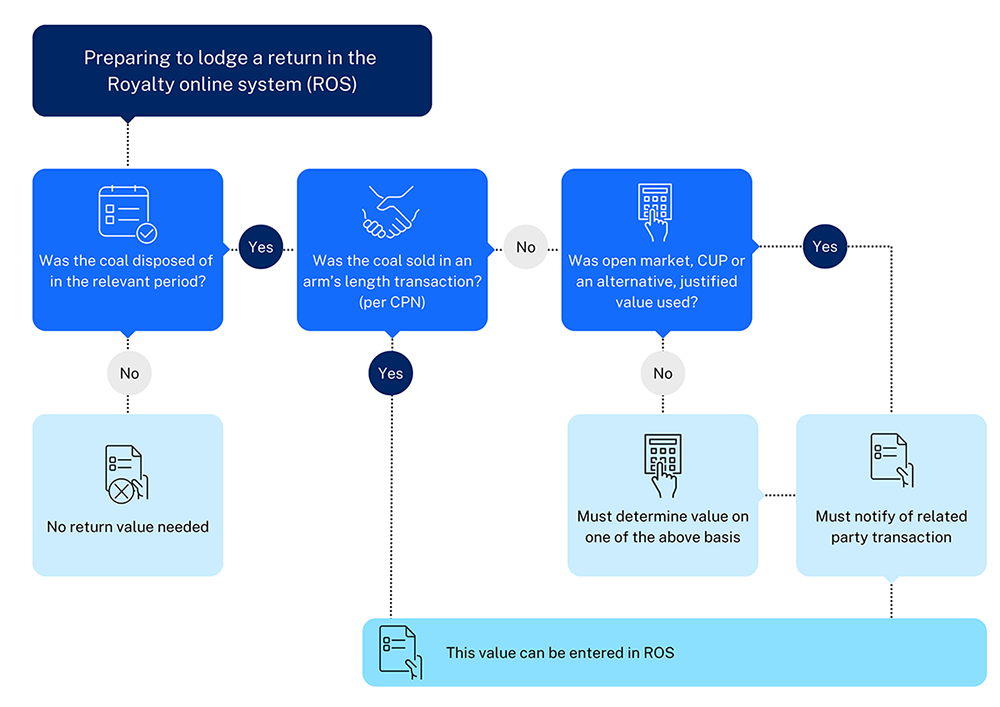

Flow chart

Unclear or disputed matters - Assessable Revenue

An Authorised Officer12 may in a particular case determine whether any unclear or disputed matter is included in assessable revenue (and any incidental question in the calculation of assessable revenue) and the amount of assessable revenue (or any component thereof).

Referral of certain objections - Quantity and mine classification

Under section 291B of the Mining Act, the Chief Commissioner is to refer objections that have been lodged under the Taxation Administration Act 1996 (the TAA) a dispute about any of the following matters to the Minister, who may make a determination with respect to that matter:

- the quantity of minerals disposed of or held by the holder of a mining lease,

- the quantity of coal disposed of by the holder of a mining lease, and

- whether, and the extent to which, coal was recovered by open cut mining, underground mining, or deep underground mining.

Unclear matters - Private rulings

Private rulings provide taxpayers with clarity on complex tax matters, helping them make informed decisions, mitigate risks, and ensure compliance.

For enquiries, contact the Technical Advisory Branch at private.ruling@revenue.nsw.gov.au. More details are available at Private rulings.

Retaining records

Pursuant the Regulation13 records must be retained by the Holder of the mining lease for a period of at least 7 years after the end of financial year in which the extraction to which the records relate occurred.

Interest and penalties

In accordance with the TAA14, where there is evidence of the taxpayer failing to reasonable care or the taxpayer has shown intentional disregard to the law, the Chief Commissioner may impose additional interest and penalty charges.

Examples

On 5 April 2023, ABC Pty Ltd (Holder) disposed of 100,000 tonnes of coal. This coal was sold to DEF Marketing Pty Ltd for US$110 per tonne pursuant to a two-year contract. The average listed price on index at this time is US$105 per tonne.

ABC Pty Ltd determines that the transaction was an arm’s length transaction. This includes considering:

- That DEF Marketing Pty Ltd is not a Relevant Entity of ABC Pty Ltd.

- Although the price of $110 per tonne is higher than the average listed price, this is on account of the more favourable payment terms offered by ABC Pty Ltd in the contract.

- The overall market conditions at the time.

As the transaction was an arm’s length transaction, ABC Pty Ltd returns the price charged for the disposal. At the time of sale, the USD/AUD exchange rate was $0.62.

April return

Value of ABC Pty Ltd coal

Value = Sale price per tonne X Quantity (tonnes) of ABC Pty Ltd recovered coal which has been disposed.

Value = US$110 X 100,000

Value = US$11,000,000

AUD = $17,741,935.48 AUD ($0.62/AUD)

On 5 April 2023, ABC Pty Ltd (Holder) disposed of 100,000 tonnes of coal. This coal was sold to GHI Marketing Pty Ltd for US$110 per tonne. ABC Pty Ltd and GHI Marketing Pty Ltd are Relevant Entities, so the transaction is a related party transaction.

The agreement between ABC Pty Ltd and GHI Marketing Pty Ltd is dated 1 February 2023 and provides that the price paid for the coal (export) shall be calculated on a FOB per metric tonne basis using an appropriate index price (i.e. gCNEWC Index) with appropriate ajustments and penalties/bonus applied depending on the quality of the coal.

Although the disposal is presumed to be not an arm’s length transaction, ABC Pty Ltd considers all the circumstances of the transaction and is of the view that it is an arm’s length transaction and returns the price charged for the disposal.

At the time of sale, the USD/AUD exchange rate was $0.62.

April return

Value of ABC Pty Ltd coal

Value = Sale price per tonne X Quantity (tonnes) of ABC Pty Ltd recovered coal which has been disposed.

Value = US$110 X 100,000

Value = US$11,000,000

AUD = $17,741,935.48 AUD ($0.62/AUD)

In the return, ABC Pty Ltd notifies Revenue NSW that the value of coal recovered involves a related party transaction. ABC Pty Ltd must ensure that it retains evidence that, while the transaction was a related party transaction, the terms of the disposal still represented an arm’s length transaction, and the sale price was still an arm’s length price.

On 5 April 2023, ABC Pty Ltd (Holder) disposed of 100,000 tonnes of coal to XYZ Marketing Pty Ltd. ABC Pty Ltd and XYZ Marketing Pty Ltd are Relevant Entities, so the transaction is a related party transaction.

As XYZ Marketing Pty Ltd is a related marketing arm of the same holding company, the coal was disposed for only a nominal amount of US$5 per tonne.

ABC Pty Ltd decides to use the open market value method to determine the arm’s length price to be returned in the royalty return. ABC Pty Ltd determines the open market value to be US$112 per tonne by reference to the gCNEWC Index at the time of the disposal. Accordingly, ABC Pty Ltd returns this price per tonne in the April return and not the nominal price of US$5 per tonne.

At the time of sale, the USD/AUD exchange rate was $0.62.

April return

Value of ABC Pty Ltd coal

Value = gCNEWC Index X Quantity (tonnes) of ABC Pty Ltd.’s recovered coal which has been disposed.

Value = US$112 X 100,000

Value = US$11,200,000

AUD = $18,064,516.13 AUD ($0.62/AUD)

On 5 April 2023, ABC Pty Ltd (Holder) disposed of 100,000 tonnes of coal. This coal was sold to DEF Pty Ltd. ABC Pty Ltd and DEF Pty Ltd are Relevant Entities so the transaction is a related party transaction.

DEF Pty Ltd does not mine coal as such there is no requirement to for DEF Pty Ltd to submit a return.

The agreement between ABC Pty Ltd and DEF Pty Ltd is dated 1 February 2021 and provides that the price paid for the coal (export) shall be calculated on an FOB per metric tonne basis using an appropriate index price (i.e. gCNEWC Index) with appropriate adjustments and penalties/bonus applied depending on the quality of the coal. In the agreement the disposal value is referred to as being the gCNEWC Index price at the time of disposal.

At the time of sale, the USD/AUD exchange rate was $0.62.

The gCNEWC Index for the coal is US$112 per tonne. Accordingly, this amount (assuming no quality adjustments) is to be the returned amount.

Upon reviewing the contract, the Chief Commissioner is satisfied that while the parties are related and the contract is more than 2 years old, the terms provided in the sales agreement represent an arm’s length price when the agreement was made. ABC may submit the export value of the coal pursuant to the terms of this contract.

April return

Value of ABC Pty Ltd coal

Value = gCNEWC Index X Quantity (tonnes) of ABC Pty Ltd.’s recovered coal which has been disposed.

Value = US$112 X 100,000

Value = US$11,200,000

AUD = $18,064,516.13 AUD ($0.62/AUD)

On 5 April 2023, ABC Pty Ltd (Holder) disposed of 100,000 tonnes of coal. This coal was sold to XYZ Pty Ltd for US$110 per tonne. ABC Pty Ltd and XYZ Pty Ltd are related entities. At the time of sale, the USD/AUD exchange rate was $0.62.

Upon reviewing all the relevant documents associated with the sale i.e. sales contract and sales agreement it has been identified that the price paid to ABC Pty Ltd by XYZ Pty Ltd for the coal would not be considered an appropriate arm’s length price.

On the 21 April 2023 ABC Pty Ltd sold 100,000 tonnes of coal to DEF Pty Ltd for US$112. ABC Pty Ltd and DEF Pty Ltd are unrelated entities. This sale was for similar quality coal to that it had sold to XYZ Pty Ltd on the 5 April 2023.

ABC Pty Ltd has lodged the following in the April return.

April return (for 5 April sale)

Value of ABC Pty Ltd coal

Value = Sale price per tonne X Quantity (tonnes) of ABC Pty Ltd recovered coal which has been disposed.

Value = US$110 X 100,000

Value = US11,000,000

AUD = $17,741,935.48 AUD ($0.62/AUD)

In reviewing the return (and associated documents) for both the sales of 5 April 2023 and 21 April 2023, the Chief Commissioner forms the view that the US$112 is the correct returning value for the 5 April sale

Value of ABC Pty Ltd coal

Value = Sale price per tonne X Quantity (tonnes) of ABC Pty Ltd recovered coal which has been disposed.

Value = US$112 X 100,000

Value = US11,200,000

AUD = $18,064,516.13 AUD ($0.62/AUD)

Following this sale, the Chief Commissioner issued an assessment with a price substitution of $US112.00 p/t. In reviewing all available documentation, it was determined that no additional interest or penalties would be imposed.

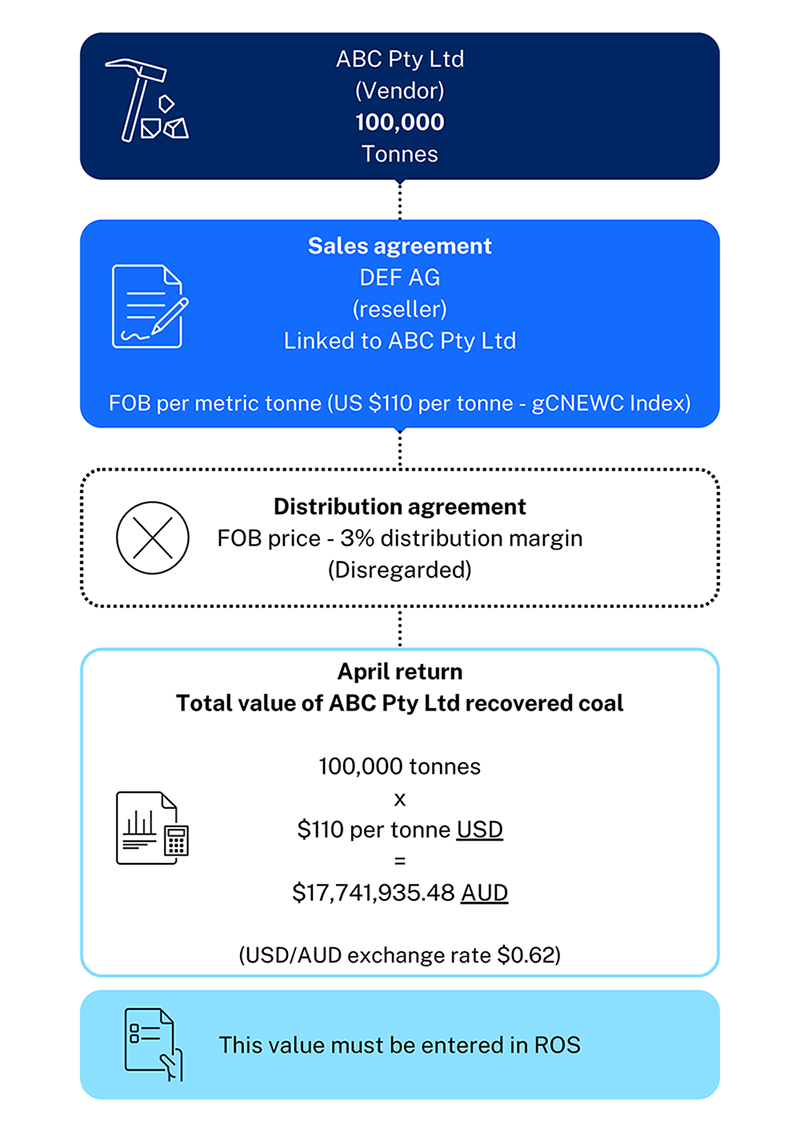

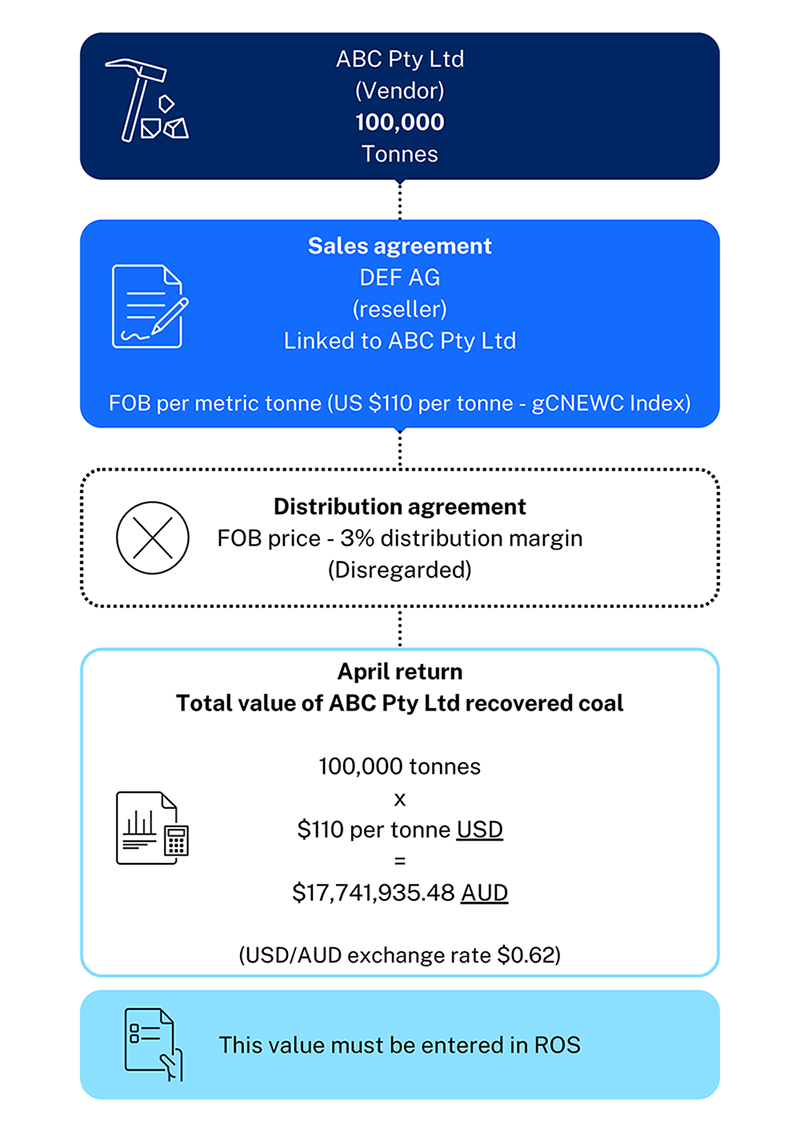

On 5 April 2023, ABC Pty Ltd (Holder) disposed of 100,000 tonnes of coal. This coal was sold to DEF AG for US$110 per tonne. ABC Pty Ltd and DEF AG are related entities.

DEF AG is in the business of marketing or reselling coal and the company does not mine coal, so there is no requirement for DEF AG to submit a return.

The sales agreement between ABC Pty Ltd and DEF AG, dated 1 February 2023, it stipulates that the price paid for the exported coal will be calculated on an FOB per metric tonne basis, using an appropriate index price (such as the gCNEWC Index), with appropriate adjustments and penalties or bonuses applied based on the coal's quality.

An additional agreement (referenced as being the distribution agreement) between ABC Pty Ltd and DEF AG specifies the distribution terms whereby a 3% distribution margin will be deducted from the FOB price listed in the sales agreement (between ABC Pty Ltd and DEF AG) for the sales and marketing of the coal.

At the time of disposal the gCNEWC Index price is US $110.00

At the time of sale, the USD/AUD exchange rate was $0.62.

ABC Pty Ltd has lodged the following in the April return.

April return

Value of ABC Pty Ltd coal

Value = Sale price per tonne X Quantity (tonnes) of ABC Pty Ltd recovered coal which has been disposed.

Value = US$110 X 100,000

Value = US$11,000,000.00 (less 3% as referenced in the distribution agreement)

Value = US10,670,000.00

AUD = $17,209,677.42 AUD ($0.62/AUD)

In reviewing the return, the Chief Commissioner forms the view that the distribution margin referred to in the distribution agreement does not represent an arm’s length value and considers that the FOB price listed in the sales agreement represents the arm’s length value of the coal (i.e. the amount prior to the distribution margin being deducted).

An assessment was issued to ABC Pty Ltd on the following basis:

April return

Value of ABC Pty Ltd coal

Value = Sale price per tonne X Quantity (tonnes) of ABCs Pty Ltd recovered coal which has been disposed.

Value = US$110 X 100,000

Value = US$11,000,000

AUD = $17,741,935.48 AUD ($0.62/AUD)

Where the Chief Commissioner is not satisfied that an arm’s length value has been struck between ABC Pty Ltd and DEF AG then a price substitution may occur. Prior to making a price substitution, various documentation will be requested by the Chief Commissioner. Penalties and conviction may apply to any non-compliance of these formal requests.

Depending on particulars of the case, interest and penalties may apply to the assessment