Purpose

This Commissioner’s Practice Note is relevant to all Australian-based developers that are foreign persons (“ABD”) and wish to apply for an upfront exemption from surcharge purchaser duty and/ or surcharge land tax.

Note: The Chief Commissioner may approve an upfront exemption if the person is likely to become entitled to a full refund amount of surcharge purchaser duty and surcharge land tax.

Background

Under sections 104ZJA of the Duties Act 1997 or 5C of the Land Tax Act 1956, the Chief Commissioner may apply an exemption to a surcharge liability if satisfied that the foreign person will use land for the construction and sale of new homes or will subdivide and sell the land for the purpose of constructing new homes.

Revenue Ruling G 013 Exemption for foreign Australian-based developers has detailed guidance on how and when the exemption applies, the circumstances in which the exemption may be revoked and on the provision of refunds where an exemption is granted after surcharge has been paid. This practice note should be read in conjunction with the revenue ruling.

Commissioner's Practice Note

In order to be granted an upfront exemption from surcharge purchaser duty, the ABD must confirm that they will either construct and sell new homes or subdivide the land for the purpose of constructing new homes. The only evidence needed for an upfront exemption to be granted, apart from confirming that they are an Australian corporation, will be the approval letter[i] from the Foreign Investments Review Board (“FIRB”). The exemption will also apply to surcharge land tax from the next land tax year.

If, at the time of lodging the contract for stamping, the ABD has applied to FIRB and is waiting for the decision to be made, a conditional exemption will be granted with a proviso that Revenue NSW will be provided with a copy of the FIRB approval within 28 days from the date of the decision.

If the ABD is developing the land with another developer who is foreign but not an ABD, then evidence must be provided as to the nature of the relationship, the ownership interest and any other relevant facts. In these instances, only a partial exemption will be granted.

Example

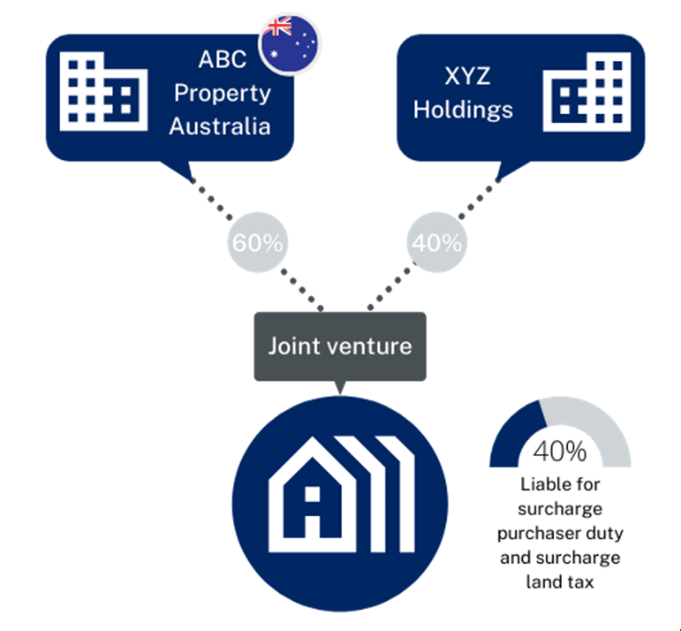

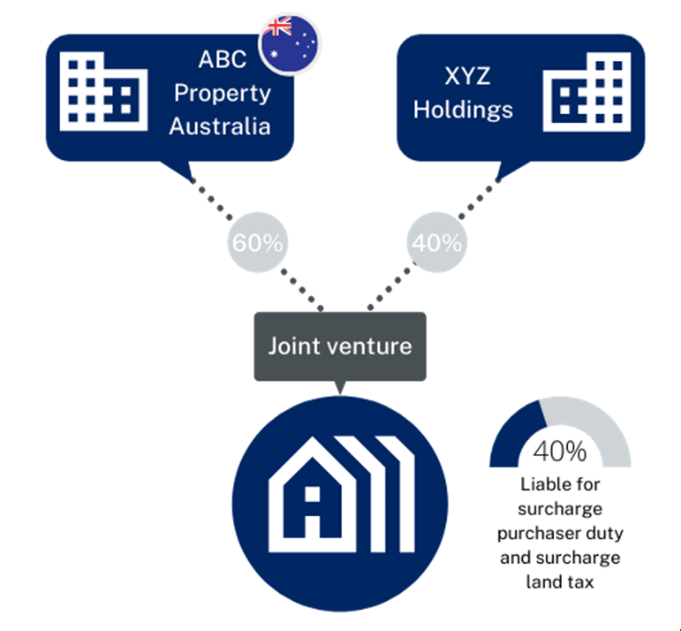

ABC Property Australia (“ABC”) and XYZ Holdings (“XYZ”) enter into a joint venture to develop residential property in Westmead. ABC is an Australian-based developer who is a foreign person and has a 60 percent interest in the joint venture and XYZ is a foreign person (but not an Australian Based developer) with a 40 percent interest in the joint venture. Both ABC & XYZ have approval from FIRB. However, since XYZ is not an Australian based developer, the 40% interest will still be liable to surcharge purchaser duty and surcharge land tax.

The ABD’s will be periodically audited to check for non-compliance of any conditions attached to the exemption. These conditions are set out in Paragraphs 9 -11 of Revenue Ruling G 013. However, all new ABD’s will need to provide an annual account of the construction underway. This would include development timetables, development approvals, work undertaken etc.

The exemption can be revoked at any time in the circumstances set out in Paragraphs15-17 of Revenue Ruling G 013 and, if so, surcharge purchaser duty and surcharge land tax will become payable.

Footnotes

[i] The approval letter could include a standalone approval letter, an exemption certificate to purchase land to develop residential property, a blanket exemption to purchase residential property or any other form of approval or exemption to build residential property approved by the Chief Commissioner.